The United States says its new tariffs are meant to punish India for buying Russian oil. Don’t be fooled. This is about far more than crude shipments. It is about trust, respect, and the way Washington now treats even its closest partners. And that trust has been broken.

Ankit Patel Shares Practical Wealth-Building Strategies for Your 30s in ABP Live Business Article

30s Aren’t Too Late To Catch Up On Long-Term Wealth Planning: Here’s How

There’s something about hitting your 30s that makes money feel very real. Maybe it’s the EMI reminders, or the wedding invites piling up, or just the growing sense that “I should probably be doing more with my income.” Whatever it is, this is the decade where your financial decisions start compounding, literally and metaphorically.

And no, it’s not too late. But it’s also not too early to start.

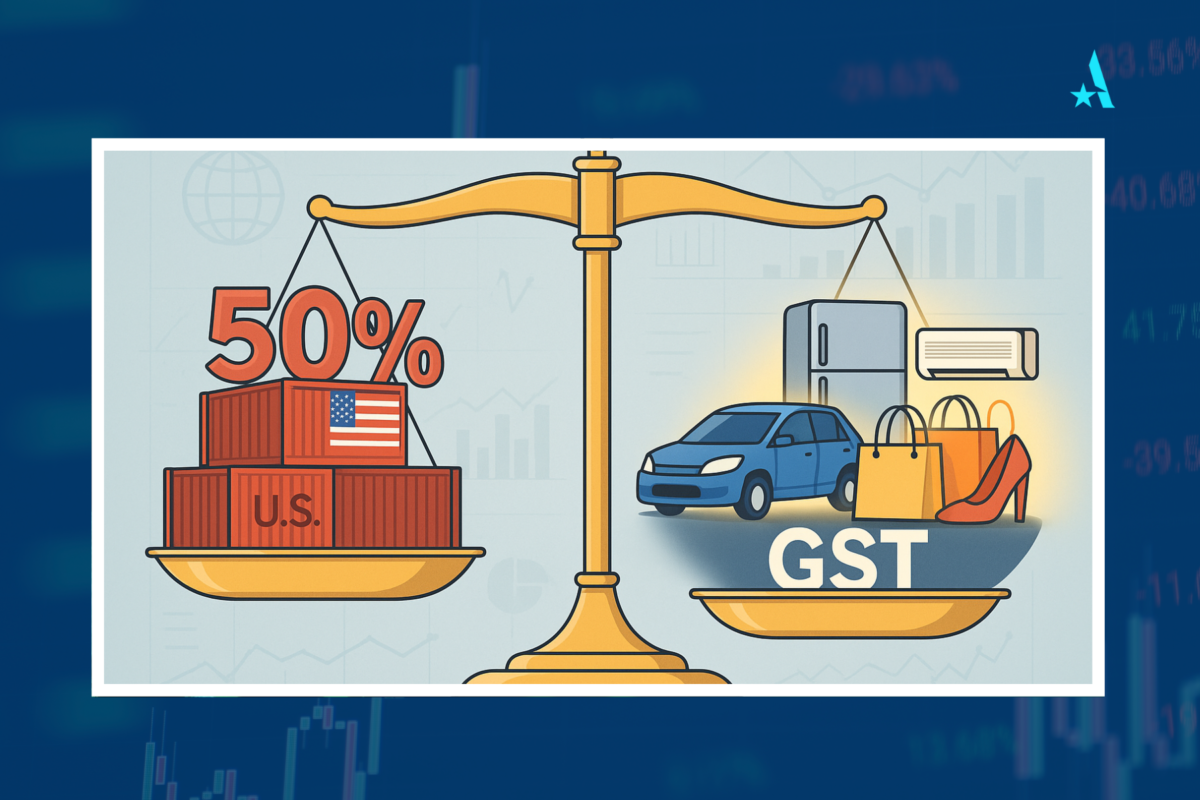

India’s Consumer Tax Overhaul to Offset U.S. Tariff Pains

India’s economy is being buffeted by two very different forces. On one side, the Trump administration has slapped steep new tariffs on Indian exports, threatening growth and jobs in key industries. On the other, the Modi government has rolled out the most ambitious reform of the Goods and Services Tax (GST) since its launch, cutting consumer taxes to spark a wave of domestic demand. For investors, the key question is whether the domestic stimulus can balance the external shock.

India Today: Ankit Patel on How Much India Could Really Lose from U.S. Tariffs

US Trade Tariff Blow: How Much Can India Really Lose?

With the US slapping a fresh 25% tariff on Indian exports, ranging from auto components and textiles to electronics and gems, the threat to bilateral trade has returned to the spotlight.

Analysts say the direct hit could affect over $3 billion worth of annual shipments, though the broader impact on India’s GDP is expected to be limited.

Capitulation as Strategy: The World Grovels, and Trump Smells Blood

As the world edges closer to Trump’s August 1 tariff ultimatum, global leaders are not negotiating — they’re surrendering. One by one, governments are lining up not to bargain but to beg. And no moment captured this global humiliation more than European Commission President Ursula von der Leyen’s surreal visit to Trump’s private golf course in Scotland, where, in a scene more befitting a medieval court than modern diplomacy, she presented Europe’s tribute.