India Defies Global Market Rout as Tariff Storm Rages

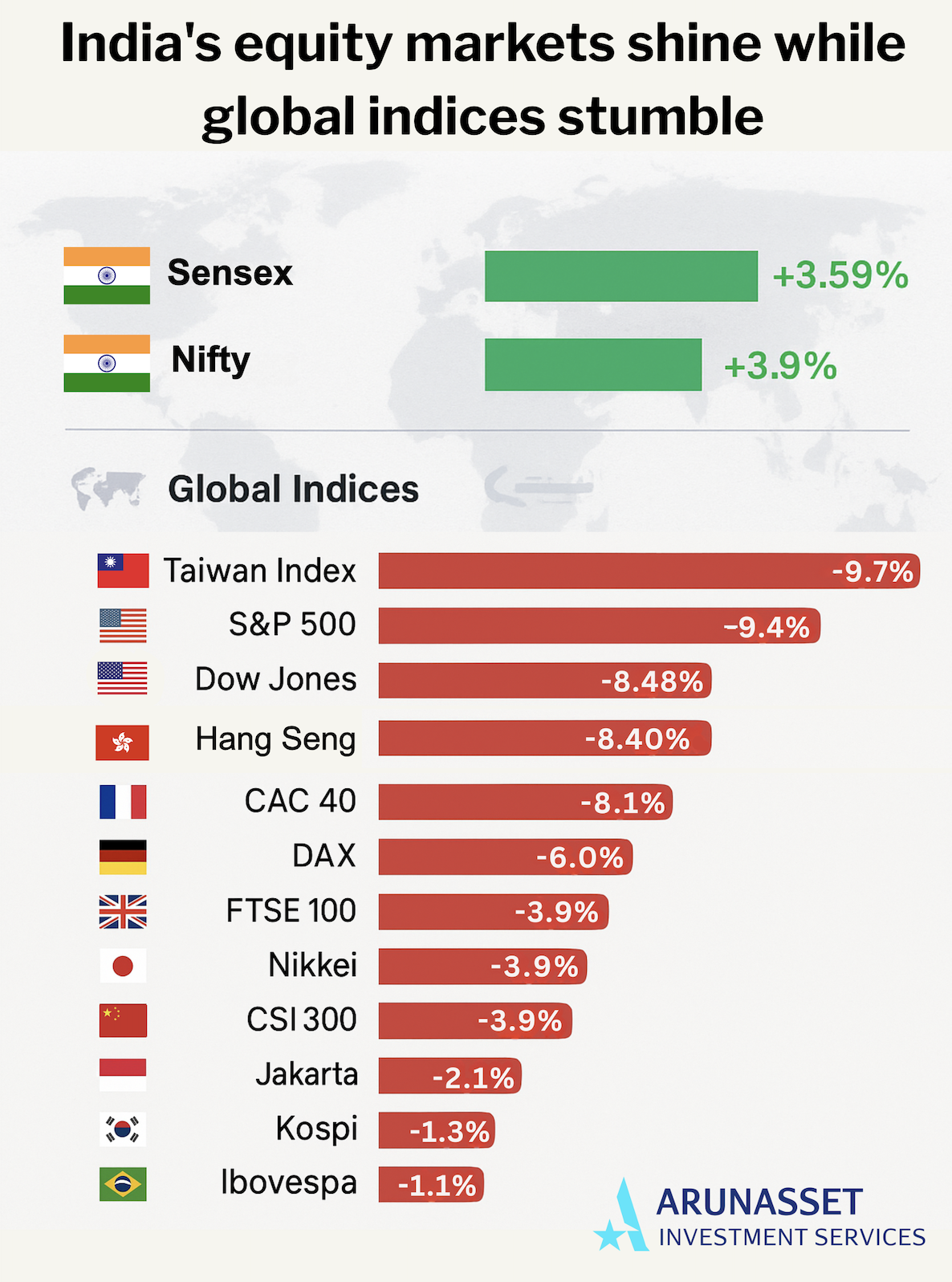

While global markets have been rattled by a fresh wave of U.S. trade tariffs, India has bucked the trend—emerging not just unscathed, but thriving. Since U.S. President Donald Trump’s April 2 announcement of new tariffs, major equity markets across the world have stumbled, yet India’s Sensex and Nifty have not only held their ground but surged ahead.

Markets Rising Against the Tide

In local currency terms, the Sensex has climbed 3.59% and the Nifty 3.9% since the tariff announcement, translating to gains of over 2% in U.S. dollar terms. Contrast this with the sharp corrections seen elsewhere, and India begins to look like the outlier in a sea of red.

This past week alone tells a remarkable story. The Nifty jumped more than 5.5%—and over 7% across five trading sessions—marking its strongest weekly rally in nearly a year. While Japan’s Nikkei edged up 1.3% and China’s Shanghai Composite gained about 2%, the U.S. S&P 500 tumbled 2.9%, continuing a broader downward trend.

A Tale of Two Economies: Consumption vs. Exports

Part of India’s current resilience lies in its economic structure. Unlike many Asian economies—such as South Korea, Taiwan, and China—India isn’t heavily dependent on exports. Domestic consumption accounts for nearly 60% of GDP. This buffers the economy when external demand slows or when global trade tensions spike.

India’s growth story is largely inward looking. So while tariffs might dent sentiment, the core engine—consumer spending, infrastructure investment, and services—remains robust.

Macroeconomic Stability: No One In the World Can Boast Such Figures

India’s macroeconomic stability in 2025 has played a crucial role in boosting investor confidence and supporting stock market performance. With inflation contained below 4%, the Reserve Bank of India has had room to maintain a balanced monetary policy, which in turn has supported consumption and investment. The government’s commitment to fiscal discipline, keeping the fiscal deficit around 4% of GDP, has reassured markets about long-term debt sustainability. Additionally, robust GDP growth of 6.5% reflects strong domestic demand and resilient economic fundamentals. Together, these indicators have created a favorable environment for equities, attracting both domestic and foreign investment into Indian stock markets.

The Numbers Paint a Stark Picture

Globally, the fallout from the U.S. tariffs has been widespread. Since April 2:

- The S&P 500 has fallen 9.4%, while the Dow Jones is down 8.48%.

- In Europe, France’s CAC 40 has dropped 8.1%, Germany’s DAX 6%, and the UK’s FTSE 100 3.9%.

- In Asia, the pain is equally pronounced: China’s CSI 300 is down 3.9%, Hong Kong’s Hang Seng 8.4%, and Taiwan’s benchmark 9.7%. Japan’s Nikkei is off 3.8%, while South Korea’s Kospi slipped 1.4%.

Even smaller regional markets like Indonesia (-2.1%), the Philippines (-1.8%), and New Zealand (-2.1%) haven’t been spared. Brazil’s Ibovespa, a bellwether for Latin America, is down 1.1%.

Diplomatic Moves and Tariff Tweaks

India has also taken proactive steps to defuse tensions with Washington. In a quiet but significant move, New Delhi reduced tariffs on select American exports—high-end motorcycles dropped from 50% to 30%, bourbon whiskey from a punishing 150% to 100%, and telecom equipment halved from 20% to 10%. These gestures signal willingness to negotiate, even as larger global economies dig in for a prolonged dispute.

The Oil Dividend

Another factor fueling India’s outperformance: tumbling crude oil prices. As one of the world’s largest oil importers, India’s economy is highly sensitive to energy costs. Lower oil prices have helped narrow the trade deficit and cool inflationary pressures, giving policymakers more room to maneuver.

Early Signs of Corporate Optimism

Back home, corporate India is showing signs of cautious optimism. Preliminary earnings estimates for the June quarter suggest 2–3% growth—modest, but significant against a backdrop of global uncertainty. Sectors like FMCG, banking, and IT have led the charge, buoyed by strong domestic demand and stable macroeconomic indicators.

Looking Ahead: Will the Momentum Last?

While India’s current resilience is noteworthy, it doesn’t mean it’s immune to global shocks. Capital flows can reverse quickly, and a prolonged trade war could eventually dent investor confidence. But for now, India is enjoying a rare moment in the spotlight—where its unique economic model, policy flexibility, and diplomatic savvy are keeping it afloat while others flounder.

- Sensex 3.59%

- Nifty 3.9%

- Dow Jones -8.48%

- S&P 500 – 9.4%%

- FTSE 100 – 3.9%

- CAC – 8.1%

- DAX – 6%

- Nikkei – 3.9%

- CSI 300 – 3.9%

- KOSPI – 1.3%

- Taiwan Stock Index – 9.7%

- Jakarta – 2.1%

- Hang Seng – 8.4%

- Ibovespa – 1.1%