In the full Budget presented today by Finance Minister Nirmala Sitharaman, the government has set its fiscal deficit target at 4.9% of GDP for the financial year 2024-25. This target is lower than the 5.1% projected in the interim budget in February and is closer to the 4.5% target set for 2025-26.

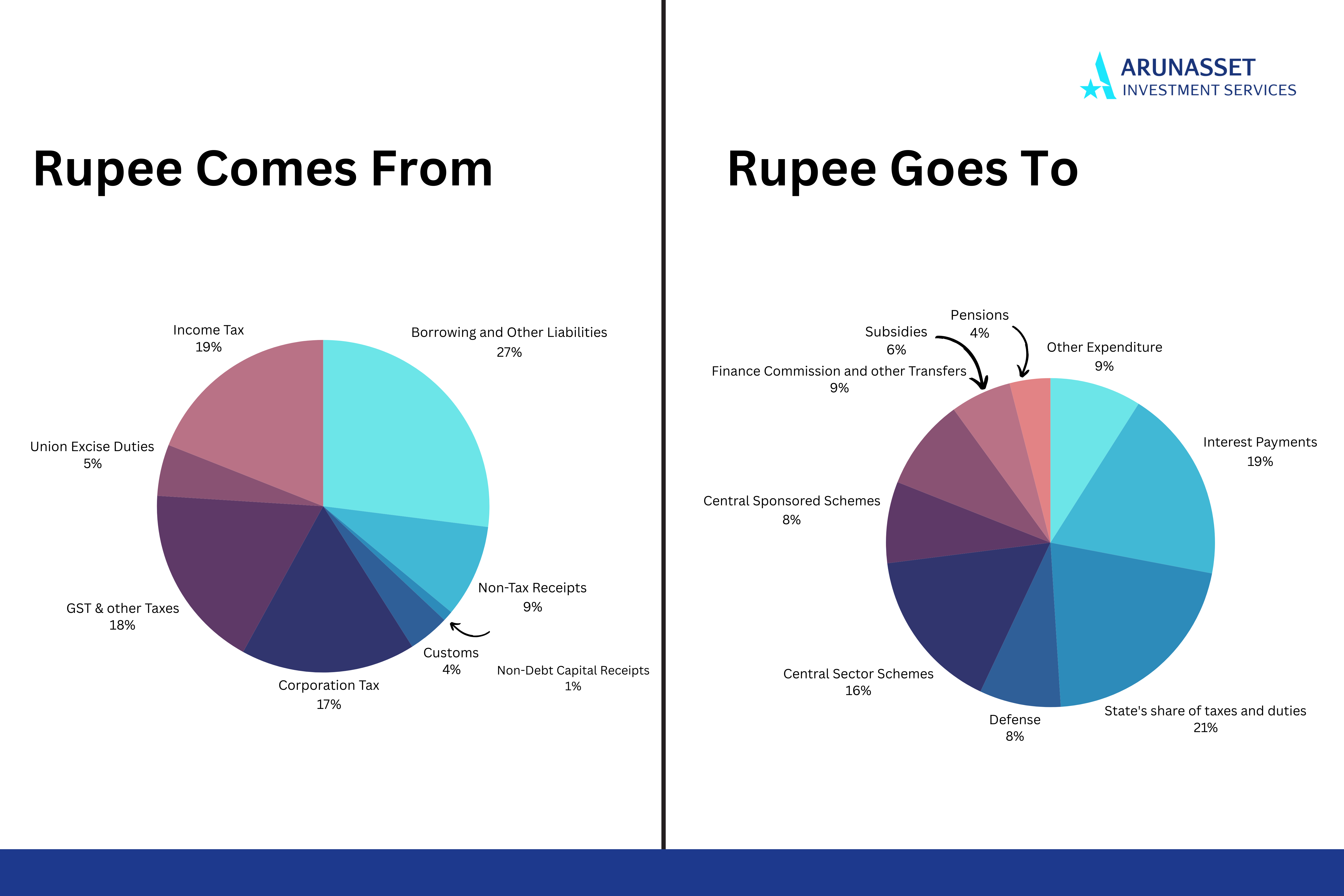

- FY25 Total Receipts estimated at ₹32.07 lakh crore

- FY25 Total Expenditure estimated at ₹48.21 lakh crore

- Net tax receipts estimated at ₹25.83 lakh crore

- FY25 Fiscal deficit estimated at 4.9% of GDP

Revised Tax Structure for New Income Tax Regime

According to an analysis by Ernst & Young (EY), individuals will be exempt from paying taxes on income up to ₹7.75 lakhs.

For those earning up to ₹10 lakhs annually, the potential savings amount to ₹10,000 before applying cess, with the total benefit expected to increase once cess is factored in. Taxpayers earning over ₹12 lakhs will benefit from a tax savings of ₹10,000 due to rate rationalization.

However, the savings from the standard deduction increase will vary across income groups. Taxpayers in higher brackets will experience lower savings compared to those in lower brackets.

Revised tax slabs under the New Tax Regime:

- ₹0-3 lakh – Nil

- ₹3-7 lakh – 5%

- ₹7-10 lakh – 10%

- ₹10-12 lakh – 15%

- ₹12-15 lakh – 20%

- More than ₹15 lakh – 30%

- Standard Deduction amount raised to ₹75,000

Capital gains taxes hiked, indexation benefit discontinued for property sale

The budget has announced increases in both long-term and short-term capital gains taxes. Additionally, the government proposes to eliminate the indexation benefit for property sales, which previously allowed property owners to adjust gains for inflation.

The short-term capital gains tax has been raised from 15% to 20%, while the long-term capital gains (LTCG) tax will be a flat 12.5%.

On a positive note, Finance Minister Nirmala Sitharaman has proposed an increase in the exemption limit for capital gains on certain listed financial assets from ₹1 lakh to ₹1.25 lakh per year, benefiting the lower and middle-income classes.

Listed financial assets held for over a year are classified as long-term. Unlisted financial assets and all non-financial assets must be held for at least two years to be considered long-term.

However, unlisted bonds and debentures, debt mutual funds, and market-linked debentures will be taxed on capital gains at applicable rates, regardless of the holding period.

All these proposals will take effect immediately.

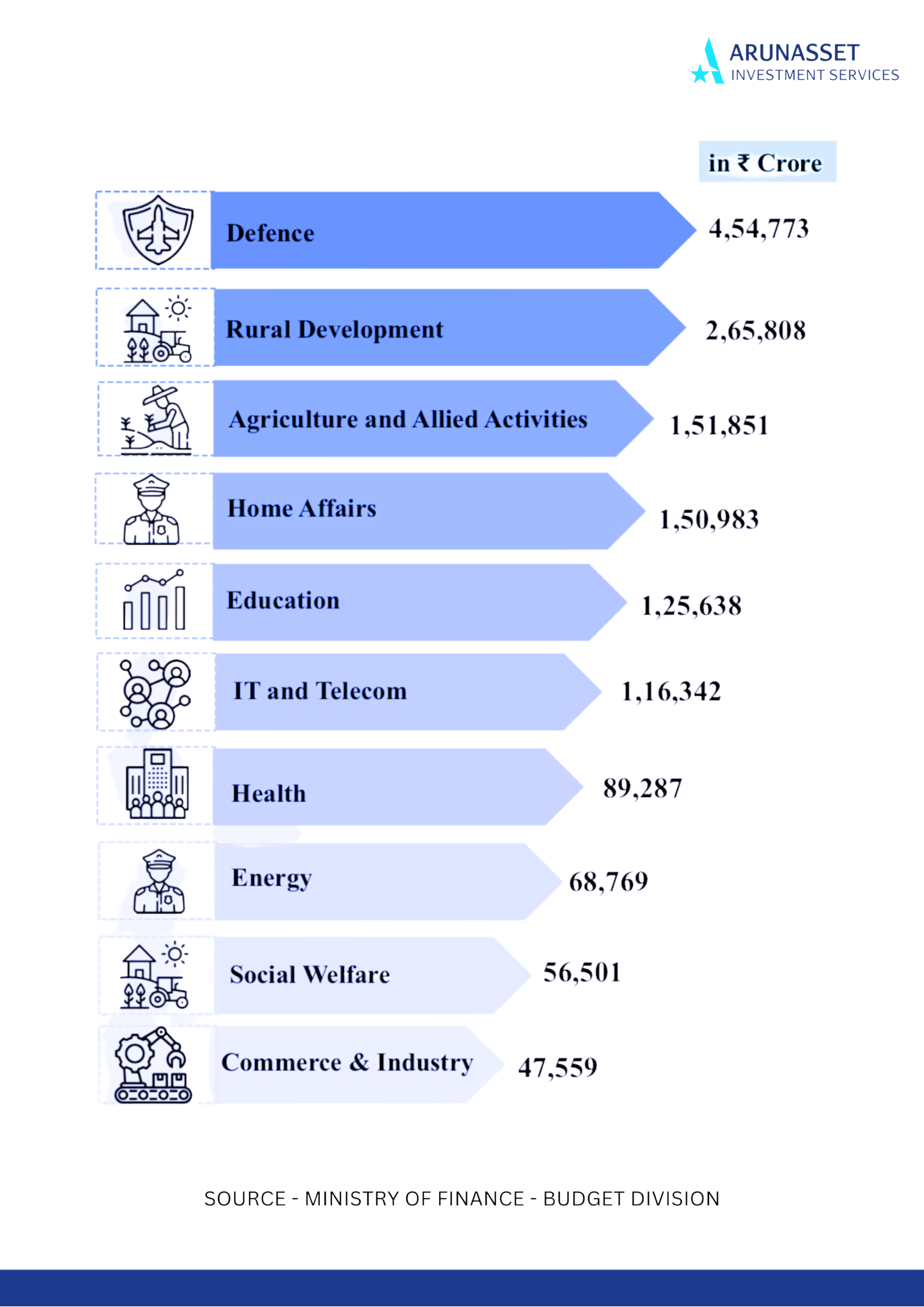

Expenditure of Major Items