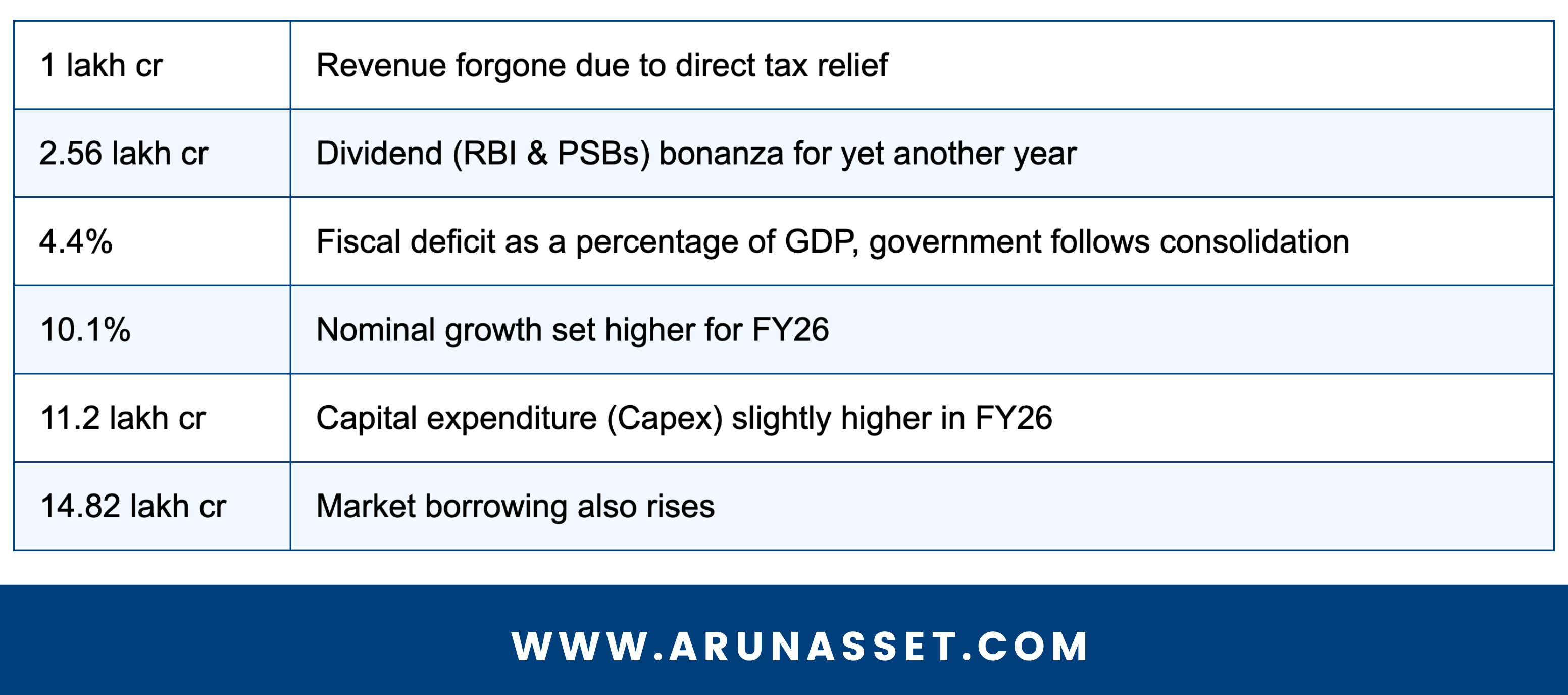

Boosts Consumer Spending With An Extra Rs 1 Lakh Crore & Stays Committed to Fiscal Discipline

Budget 2025 drives consumption with personal income tax cuts & indirect tax reductions. Income tax changes will return Rs 1 lakh crore to taxpayers in FY26, though the effective gain may be slightly lower. Indirect tax cuts, like reduced customs duties on mobile phone inputs, are set to spur spending and premiumization.

This Budget brings major tax relief, with no income tax on earnings up to Rs 12 lakh. The revised tax regime simplifies taxation for the middle class, extending the tax-free limit to Rs 12.7 lakh with deductions. Those earning up to Rs 25 lakh will benefit from tax savings of up to Rs 1.1 lakh.

The finance ministry sets an ambitious fiscal deficit target of 4.4% of GDP for 2025-26, surpassing the earlier goal of 4.5%. The revised fiscal deficit for 2024-25 stands at 4.8%, lower than the budgeted 4.9%, despite a 6.9% rise in expenditure to Rs 50.63 lakh crore. Revenue growth, including an 11% rise in tax collections and higher non-tax revenues, supports this fiscal prudence. The budget strikes a balance between fiscal discipline and socio-economic priorities, with the primary deficit contained at 0.8% of GDP.

Budget 2025 shifts focus from capex to consumption, allocating ₹11.21 lakh crore for capital expenditure—a modest 0.9% rise from FY25. However, the allocation is lower than the ₹11.5 lakh crore planned for FY25, signaling a potential shift due to political and welfare-driven priorities. Effective capital expenditure, including states, is projected at ₹15.48 lakh crore for FY26, while the revised estimate for FY25 was lowered to ₹13.18 lakh crore from ₹15.01 lakh crore.

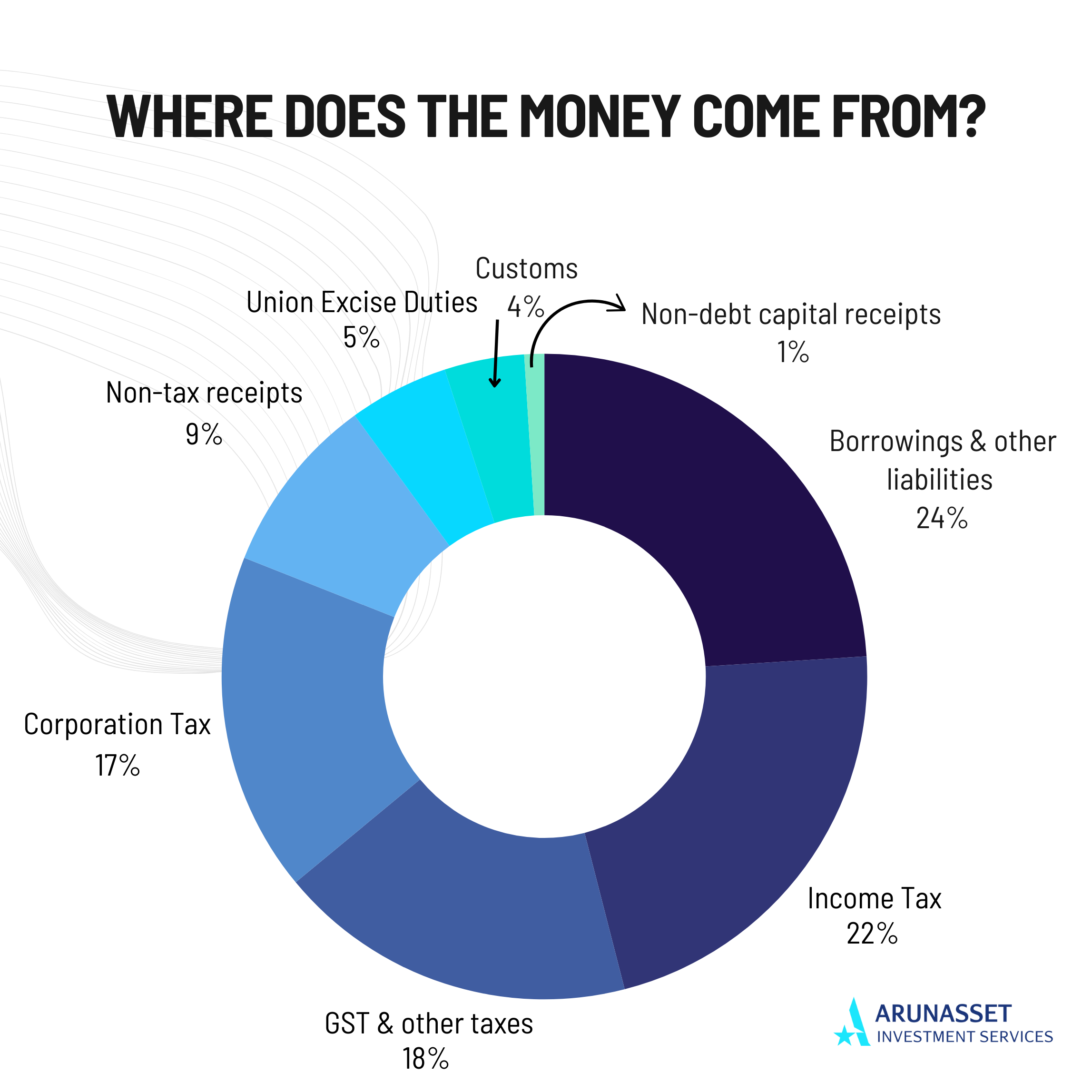

Where/How Will India Make Money

Borrowings and liabilities remain the largest revenue source for Budget 2025 at 24%, down from 27% last year. Income tax follows at 22% (up from 19%), while GST and other taxes contribute 18%, unchanged from FY25. Corporation tax accounts for 17%, with the remaining funds coming from non-tax revenue, excise duties, customs, and non-debt capital receipts.

Where Will India Spend Her Money

In Budget 2025, 22% (up from 21% last year) is allocated to the state’s share of taxes and duties, followed by 20% for interest payments. Central sector schemes receive 16%, while Finance Commission transfers, defense, and centrally-sponsored schemes each get 8%. Miscellaneous expenses account for 8%, subsidies 6%, and pensions 4%.