As investors, what we are really trying to do is to ensure that we have enough money for a goal in the future. This goal may be a comfortable retirement, children’s education or a big purchase. The risk to us, simply put, is that we will fail to achieve that goal. This may happen because of many different reasons. A practical approach, which we can all adopt, is to know what these reasons could be and what steps we can take to protect ourselves.

The first risk is not knowing what the risks are. Every investment, including the so called safe ones like bank deposits, insurance and cash under the mattress carries risk of one kind or another. I hope that this article will add to your understanding of risk and help you be better prepared.

The second risk is that we underestimate the goal. This usually happens because we fail to take inflation into account. A lakhpati was a big deal in the 1960′s when 50 rupees was a good salary (remember the black and white movies and the hero celebrating his first job?). Today it is not. So, you need to make sure that 40 years from now when you’re watching a rerun of Vicky Donor, you don’t wonder why you thought a Crore was a big amount in 2013! Your goals will increase in value with time and you need to make that inflation adjustment.

Let’s assume that we’ve estimated the goal correctly. We may still not be able to meet it because our corpus did not grow to that amount. This is the third risk.

To achieve a particular goal value, we have three contributing components:

- How much you invest

- How much net return that investment generates, and

- How long you invest for

The three are related. For the same goal you can invest less if your expected return is higher, or if you are investing for longer. To take an example: If you want 115 rupees one year from now, you can do one of the following:

- Invest 100 rupees in an investment that gives 15% (Higher return)

- Invest 105 rupees in an investment that gives 10% (Higher amount)

- Invest 100 rupees in an investment that gives 7% for two years (Longer period). *

We need to make the choice that is appropriate for us by striking the right balance between our goal, our ability to invest, choice of investment option and the time period. We need to remember that you cannot put 100 rupees under your mattress or into an investment generating 10% and expect to get back 115 rupees. This is a mistake unknowingly made by investors when they focus on only one aspect. Opting for lower return investments will mean that you should be prepared to invest more or for longer. There is no other way.

For the purpose of this post we’ll assume that we have correctly estimated our goals and also worked out how much we need to invest and for how long at our target expected rate of return. We’re feeling pretty confident now. Understanding the next set of risks – things beyond our control – is important for us to continue being confident.

Risk #4 – What happens if the expected return does not materialise.

Expected return is just that – ‘expected’. It’s usually a long term average for an asset class. For example expected return for equity in India is 16%. But the return we get will most likely be different – either higher or lower. There are usually three reasons for returns being lower than expected.

One reason is that we chose the right asset class (e.g. equity) but the wrong investment (e.g. specific stock or mutual fund). This is a risk that has to be managed by monitoring the performance of your investment choice against the benchmark for the asset class. Does your chosen stock or mutual fund perform in line with the benchmark? If it under-performs, you need to replace it with another. An annual review of your investments is a good idea.

This particular risk is enhanced when we use a passive investment strategy like a SIP (systematic investment plan). SIP is a disciplined investment strategy and works really well for long term investors with a regular income. But if you don’t review the performance of the mutual fund into which your SIP is going, you maybe in for a rude shock. As a rule, review your SIP every year.

Second reason, which affects mostly fixed maturity investments, is that you were unable to reinvest at the rate you started out with. For example: if you have a ten year horizon and choose a 5 year Bank FD giving 9% interest as an investment. When that FD matures interest rates may have declined and you may only be able to get 6% for the next 5 years. The best way to manage this risk is to align the maturity of your investments with your goal. It is however easier said than done.

Third reason, which affects mostly market linked investments, is that when when you need the money, the market is down. For example if you had invested money in equity for a goal in 2009-10, you would have needed to withdraw money with a loss of capital. To manage this, you may adopt a strategy of shifting your money from equity to debt 2-3 years in advance of your goal. So if you need 100 Rs 2 years from now, shift 50-80 rupees today into fixed income. This strategy requires active management and leaves you exposed to regret if the market moves up.

Risk#5 – The risk of losing your money.

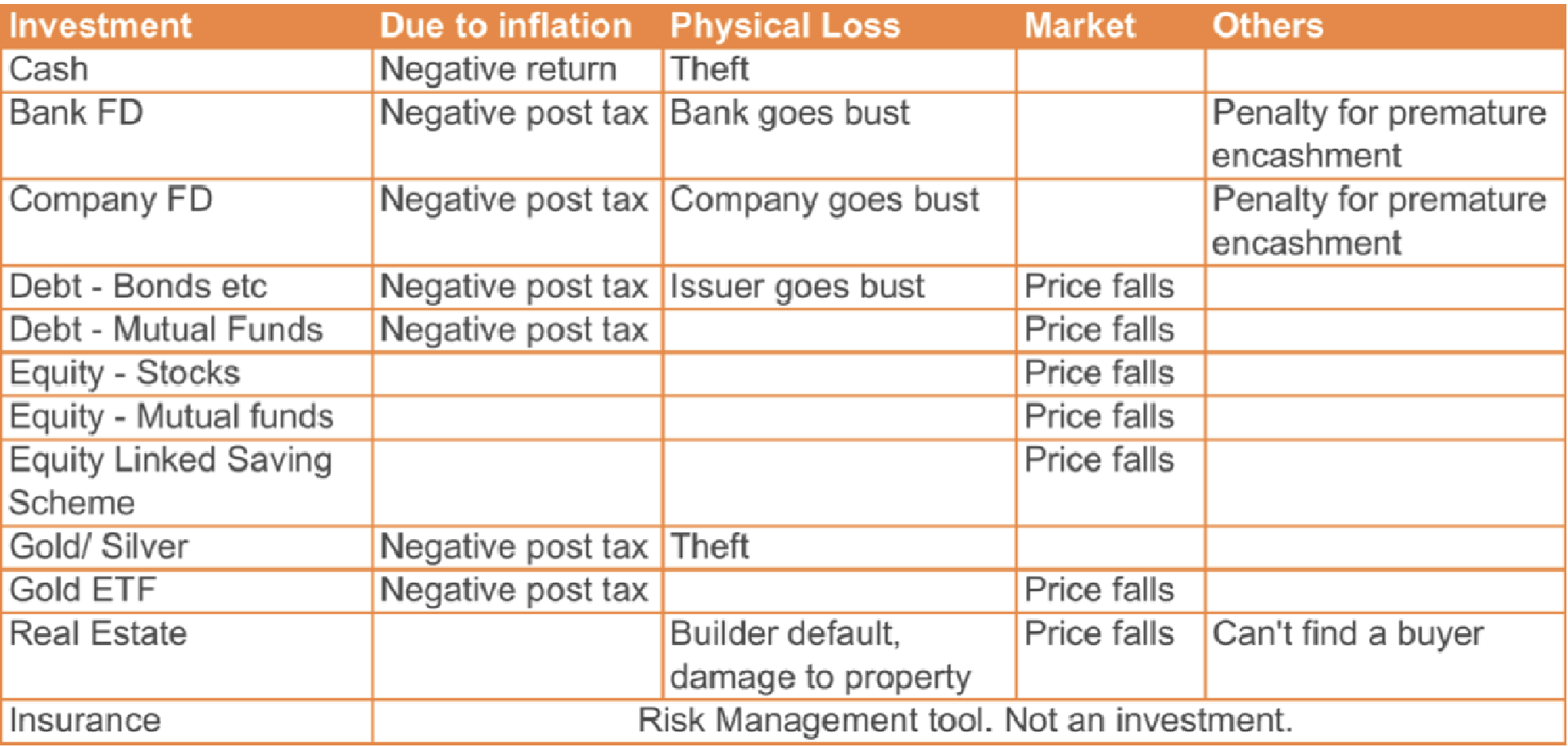

This risk varies across investments and the loss can be invisible (inflation) or very visible (Value goes down). Let’s take a look at how this applies to various common investments options:

As we can conclude from above

- No investment is “absolutely safe”

- Each investment has its own unique set of conditions which could cause you to lose money

- Safety of principal is no safety because inflation reduces the value of money

I did not mention the risk of fraud in above because:

- The government and the respective regulators have made laws and regulations to prevent against fraud in all these cases. There are also strict guidelines and oversight for entities that are permitted to take your money (Banks by RBI, Mutual funds by SEBI). Bank deposits are also covered by deposit insurance.

- A fraudster usually takes advantage of an investor’s greed by offering unrealistic returns through some sort of a scheme. If you understand what is the expected return of an investment, you would not fall prey to fraud.

Risk #6 is of not being able to save long enough

Assuming that you achieve the expected return on your investment, the only other risk is that you are either not able to save enough or for long enough. This may happen due to loss of job, accident, illness, unexpected expenses or death.

This is where Insurance comes in. Insurance fills the shortfall in your goals when you’re unable to. Health and accident insurance for disease and injury; Household Insurance for loss of property and Life Insurance in case of death. We don’t yet have layoff/redundancy insurance in India to cover job loss.

Insurance is not an investment option. It is exactly what the name implies, an insurance against your loss of ability to earn or loss of assets. How much insurance you need is driven by what stage of life you are in and what your financial plan is. If you are unable to come up with a financial plan for yourself, please seek professional advice. But if your advisor offers Insurance as an investment option – run a mile!

Conclusion: Living with risk

Now that we understand the risks we can figure out how to live with them. Our financial life is no different from our day-to-day living in this respect. We are surrounded by risks. We may slip in the bathroom, get injured while crossing the road, be in a car accident, get robbed on our way home. However we don’t choose to stay in bed. And yet we don’t suffer misfortunes everyday. This is because we take actions that help us manage those risks. We use non-skid tiles, take the over-bridge, drive within the speed limit (mostly) and take a well lit way home after dark.

Investing is similar.