India’s burgeoning tax receipts have surprised those who termed the pandemic as a death knell for India’s struggling economy. Rarely has an economic recovery been so dramatic as the one being seen now.

That India’s tax collection is on track to beat pandemic hit FY 2021 is in itself surprising. Even more surprising is that they are well positioned to beat the collections of FY 2020 which was a regular growth year. Indeed, India is in the middle of an unprecedented tax revenue generation cycle.

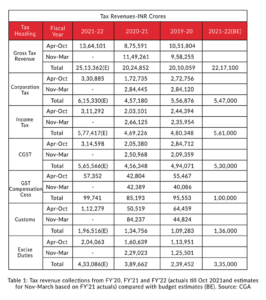

The table below reflects the actual collections in FY 2020, FY 2021 and the period between April to October 2022.

The estimates for FY 2022 are arrived at by adding the actual April to October 2022 collections to the actual November to March FY 2021 collections. We consider these as conservative because they are based on the pandemic year collections and not the steep trajectory growth of 2022. Besides, it incorporates the FY 2022 budget estimates allowing for a direct evaluation.

Let us make sense of the figures:

First, the Gross Tax Revenue.

Actual Collection in FY 2022 till October are Rs.13.64 lakh crore compared to Rs.8.76 lakh crore in FY 2021 and 10.52 crore in FY 2020 in the same period.

We make a conservative estimate for FY 2022 by adding the FY 2021 November – March figure of Rs.11.5 lakh crore which totals Rs.25.1 lakh crores. This means we are over the budget estimate of Rs.22.2 lakh crore by over Rs.3 lakh crores.

Similar analysis of tax collections under different headings in the table above reflects that Gross Tax collections might exceed budget expectations by as much as Rs.4 lakh crores. In this figure we have considered the reduction in fuel tax in November by Rs.45,000 crores.

After considering the positive run rate of tax collections we expect the Gross Tax Revenues to exceed the budget expectations by nearly Rs.4 lakh crore. This will supplement the Central Government’s net availability by about 58% which could be Rs.2.52 lakh crores.

And this is not all! Non-Tax Revenue includes dividends and other revenue from various services. RBI’s transfer of surpluses is up from Rs.53,000 crores to Rs.99,100 crores. dividend from oil companies with higher profits will further increase the Central Government’s NTR which is expected to exceed the budgeted estimates by Rs.75,000 crores. This should take care of the shortfall should the IPOs of LIC and BPCL doesn’t take place this year.

Of the Rs.4 lakh crore surplus over the budgeted estimates, 2.52 lakh crores will be available for the Central Government’s additional expenditure. Two supplemental demands are already on the table for which the net additional outgo is estimated to be Rs.3.2 lakh crores. This massive increase in expenditure includes Rs.50,000 crores for food subsidies, Rs.58,430 crores for fertiliser subsidies, Rs.53,000 crores for pending export incentives, Rs.65,000 crores to Air India, Rs.22,000 crores for MGNREGA, and a host of other items which will enable a comprehensive cleanup of past liabilities.

The budget of 2020-21 cleaned up the liability of borrowing from the National Small Saving Fund by the Food Corporation of India. This resulted in the food subsidy rising to much higher figure than the budgeted estimates. These one-time payments reflected in the government budget leading to an increase in the fiscal deficit to 9.2 per cent. FD has decreased to 6.8 per cent in FY 2022 due to this one-time payment.

The expected revenue increase in FY 2023 and the massive reduction one time expenditure in FY 2022 can be utilised for meeting accelerated infrastructure development and current expenditure demands of FY 2023 instead of past liabilities. This will assist the Indian economy to shake off the past burdens and focus on higher economic growth going forward.

The tremendous generation in revenue in pandemic times could also allow the government rework on the Income Tax Slabs for the burdened middle class. Depleted savings from loss of jobs and unexpected healthcare expenses has left the middle-class gasping. They have barely had any relief from the government despite paying increased taxes. Reducing taxes and simplifying the process will certainly go a long way in alleviating their financial well-being.