The world’s largest election commenced on April 19th and is scheduled to span six weeks, involving approximately 969 million voters and 2,600 political parties. This brief write-up delves into the consequent implications for markets and investments. The election period extends from April 19th to June 1st, with the final tallying of results on June 4th, followed by the inauguration of the new administration by mid-June.

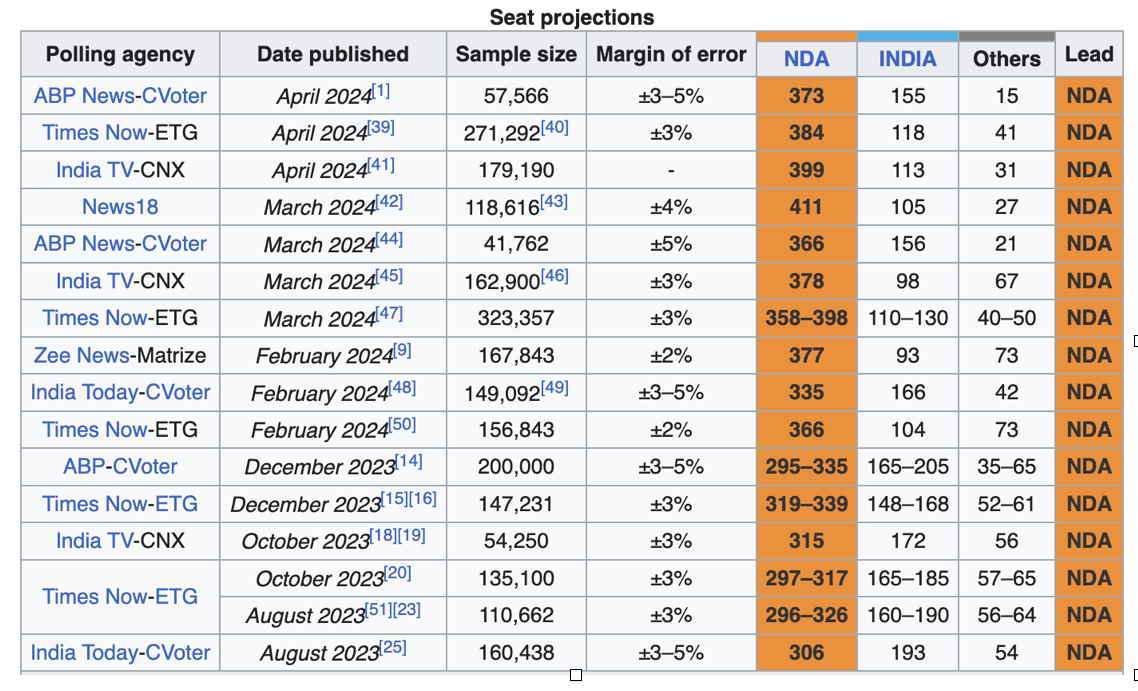

In our primary scenario, we anticipate a clear victory for the BJP, securing over 272 seats, thereby maintaining Prime Minister Modi’s leadership. Several pre-election opinion polls in India indicate a decisive triumph for the BJP.

If the BJP secures a decisive victory, it signals a continuation of policies emphasizing robust infrastructure investments and sustained efforts toward structural land and labor reforms. On the fiscal front, we anticipate the BJP maintaining its focus on deficit reduction and debt control, adhering to a fiscal deficit target of 4.5% or less of GDP by FY26.

A landslide victory for the NDA, nearing 400 seats, could trigger a highly favorable response in the equity market. Domestic sectors such as consumer staples and discretionary, industrials, infrastructure, public sector undertakings (PSUs), and financials are poised to reap benefits and potentially outperform.

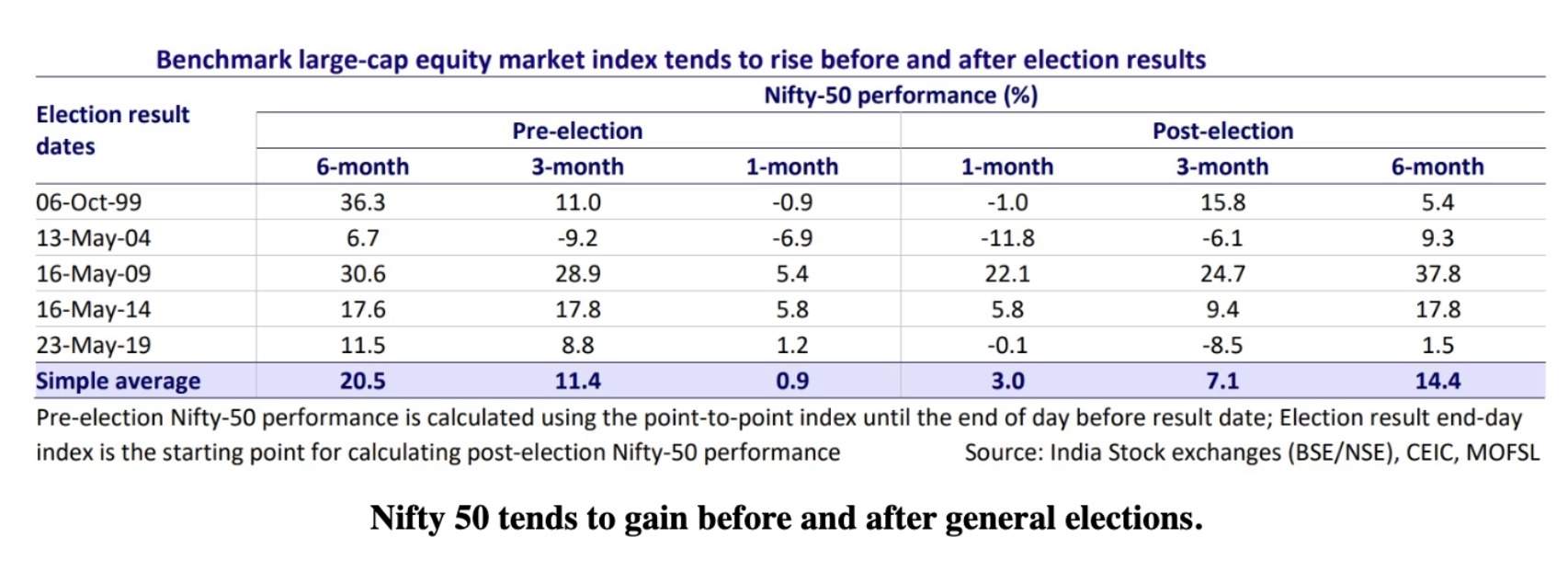

In the scenario where the BJP falls short of an absolute majority but secures it through the NDA coalition, Modi retains his premiership but may need to share power with key allies in specific ministries. While significant governance changes are not anticipated, equity markets might exhibit muted performance under this scenario, possibly witnessing a sell-off in PSUs and sectors like industrials and infrastructure. Historically, Indian equities have outpaced global and emerging market indices both pre- and post-election results, as positive market sentiment tends to prevail during election years.

If the BJP were to lose control, a notable policy shift is anticipated, moving away from prioritizing corporate profitability and towards redistributing wealth to the general populace. While such a policy could temporarily stimulate the economy and enhance corporate profitability by bolstering demand, in a country like India with surplus labor and deficient production, it risks rapidly escalating inflation. In 2019, India Inc’s profitability as a ratio to GDP was notably low, approximately 1%. However, a policy shift occurred during the government’s second term, highlighted by the corporate tax rate cuts in September 2019, resulting in India Inc’s profitability ratio to GDP climbing close to 5% today.

In the improbable event of BJP and its NDA alliance suffering a setback, significant selling pressure is anticipated across equity, bonds, and the INR, driven by investor apprehensions regarding India’s growth prospects and policy coherence.