Yesterday, the Federal reserve announced another 0.75% point increase for the federal funds rate. This is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. The increase in this rate is meant to help tame rising inflation; this increase however also has implications for the US federal governments borrowing costs and hence the nations fiscal picture.

The federal reserve held interest rates close to zero right through the pandemic. During the end of 2021; it was of the view that inflation is mostly transitory as it’s cause was primarily supply chain disruptions. It announced that that inflation would simply go away on its own. The beginning of 2022 saw the Fed do away with policy do a complete 180 degrees. US policy makers had their moment of epiphany: Helicopter dropping huge sums of money during a time when supply was severely hampered due to lockdowns, combined with China’s zero covid policy and a tussle with one of the largest commodity exporters in the world, would mean that they have problem on their hands.

US policy makers now seem to rely on increasing interest rates as their primary tool for fighting inflation. The United States’ Inability to convince oil producers to increase production, their foreign policy of the past decade that’s keeping Iran, Venezuela & Libya out of the oil market combined with politics of convenience (more free money by forgiving student loans with elections round the corner for example) has put all the burden of controlling inflation on the federal reserve.

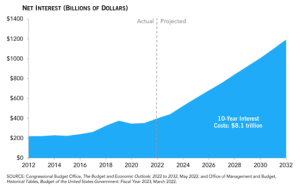

The Unites states was able to borrow money cheaply during the pandemic because interest rates were close to zero. However any increase in federal funds rates, short term rates on treasury securities will also rise. This makes federal borrowing more expensive. In fact, expectation on inflation and rise in short term rates have pushed up long term rates too. In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. It also said that if inflation expectation were to worsen and if rates were to rise further then interest costs could be even higher.

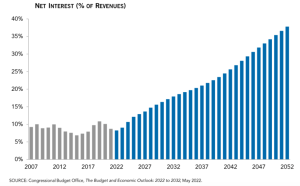

If current interest rates were to persist then this would have an impact in the long run too. Debt repayment would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest component over the next few decades. It would be higher than defense spending by approximately 2030 & higher than even medicare and social security in the following decade.

Increased spending on servicing existing loans threaten to crowd out important investments in future. When the government pays for itself by borrowing money instead of raising taxes, the burden is shifted from current taxpayers to future taxpayers. National debt necessitates a future tax increase on our children and grandchildren. While this write-up focuses on the US fiscal situation as an example, this is something that is a major issue for most economies today. Servicing loans meant to help us today, could leave less money left for future generations to spend on important areas such as defence, infrastructure & healthcare.