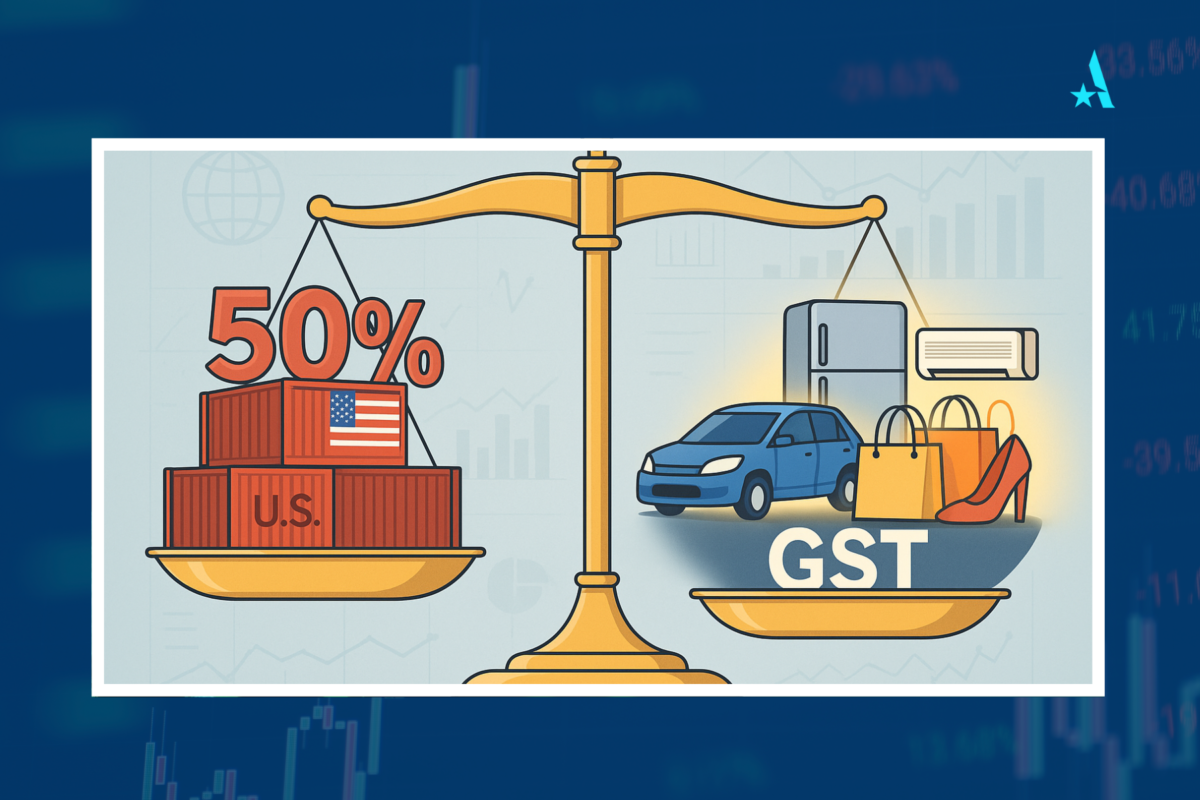

India’s economy is being buffeted by two very different forces. On one side, the Trump administration has slapped steep new tariffs on Indian exports, threatening growth and jobs in key industries. On the other, the Modi government has rolled out the most ambitious reform of the Goods and Services Tax (GST) since its launch, cutting consumer taxes to spark a wave of domestic demand. For investors, the key question is whether the domestic stimulus can balance the external shock.

India Today: Ankit Patel on How Much India Could Really Lose from U.S. Tariffs

US Trade Tariff Blow: How Much Can India Really Lose?

With the US slapping a fresh 25% tariff on Indian exports, ranging from auto components and textiles to electronics and gems, the threat to bilateral trade has returned to the spotlight.

Analysts say the direct hit could affect over $3 billion worth of annual shipments, though the broader impact on India’s GDP is expected to be limited.

Capitulation as Strategy: The World Grovels, and Trump Smells Blood

As the world edges closer to Trump’s August 1 tariff ultimatum, global leaders are not negotiating — they’re surrendering. One by one, governments are lining up not to bargain but to beg. And no moment captured this global humiliation more than European Commission President Ursula von der Leyen’s surreal visit to Trump’s private golf course in Scotland, where, in a scene more befitting a medieval court than modern diplomacy, she presented Europe’s tribute.

Outlook Money: Ankit Patel on The Prospects of IT & Retail in The Upcoming Earnings Season

Earnings Season And Personal Wealth: Where IT, Retail Stand For Investors

The stock market is currently in the midst of the Q1 FY2026 earnings season, and two key sectors which often shape market sentiment – Information Technology and Retail — find themselves at a crossroads.

According to market analysts, the retail sector maintains its momentum through consumption growth even though profit margins face challenges. There are, however, no such visible tailwinds for the IT sector during these times. Hence, such divergent earnings pressures could present selective opportunities rather than sector-wide calls.

Arun Patel Shares Disciplined Investing Strategies for Volatile Markets in His Interview with Bizz Buzz

Geopolitical uncertainties and a volatile global landscape are among the best times to invest

Geopolitical uncertainties and a volatile global landscape often unsettle investors, but history shows “these are among the best times to invest,” says Arun Patel, Founder and Partner at Arunasset Investment Services in an exclusive interaction with Bizz Buzz.