There is a huge disconnect between India’s macro fundamentals and market pricing. Equities have fallen, bond yields have risen on supply concerns, and the currency is trading near historic lows. Our macro fundamentals, however, tell a completely different picture.

Sentiment was the only thing missing—and that gap now appears to be closing. Sentiment matters enormously for both markets and the economy. When people feel confident, they spend, invest and take risk; when they don’t, they hold back. That behavioural shift shows up everywhere—from consumption and credit growth to equity flows and currency moves. The recent slowdown has been as much about caution as it has been about numbers.

The most important trigger lies in geopolitics—and that trigger has now arrived. The announcement of a trade deal between India and the US directly addresses one of the market’s biggest overhangs. A trade agreement, cooperation under the Pax Silica framework, and clearer plans around oil purchases bring India firmly into the core of American geopolitics, reinforcing its position as an indispensable strategic partner. This is precisely the kind of clarity that can lift sentiment, stabilise the currency, and improve foreign investor confidence.

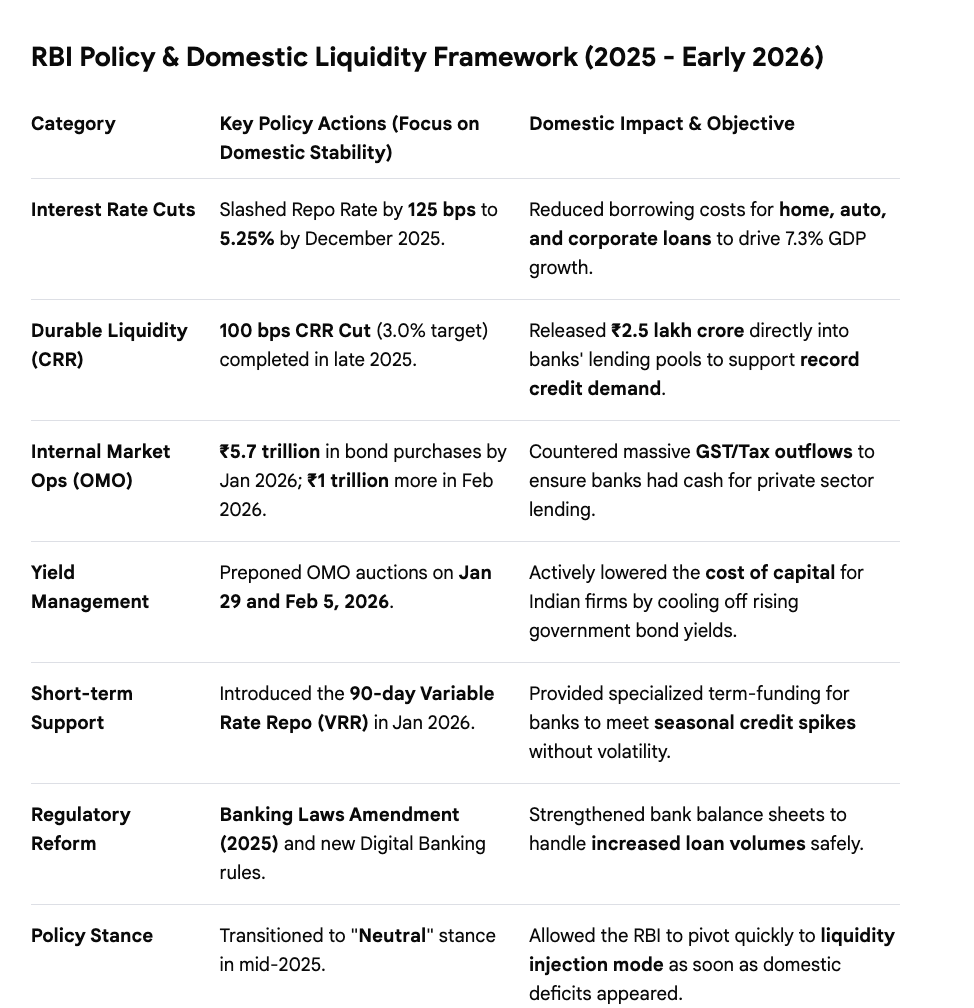

India is not facing a macro-stability problem. Real GDP growth remains among the highest in the world, with India accounting for roughly 20 percent of incremental global growth. The banking system is well capitalised and foreign exchange reserves are near record highs. Policy support from the Reserve Bank of India over the past year has been massive and front-loaded.

Despite this policy support, markets had remained cautious largely because nominal growth was weak. However, the RBI’s front-loaded actions, along with last year’s GST rationalisation, are explicitly aimed at fixing precisely this—by reviving demand, improving pricing power, and lifting nominal growth over the coming quarters.

Another positive trigger is domestic savings. Rising small-savings inflows improve the government’s funding mix and reduce reliance on market borrowings, increasing the likelihood that net bond supply turns out lower than currently feared and easing pressure on yields.

With strong real growth, aggressive policy support already in place, and sentiment now turning decisively on geopolitics and policy clarity, the current disconnect between India’s markets and its macro fundamentals looks unsustainably wide and ripe for correction.