India’s economy is being buffeted by two very different forces. On one side, the Trump administration has slapped steep new tariffs on Indian exports, threatening growth and jobs in key industries. On the other, the Modi government has rolled out the most ambitious reform of the Goods and Services Tax (GST) since its launch, cutting consumer taxes to spark a wave of domestic demand. For investors, the key question is whether the domestic stimulus can balance the external shock.

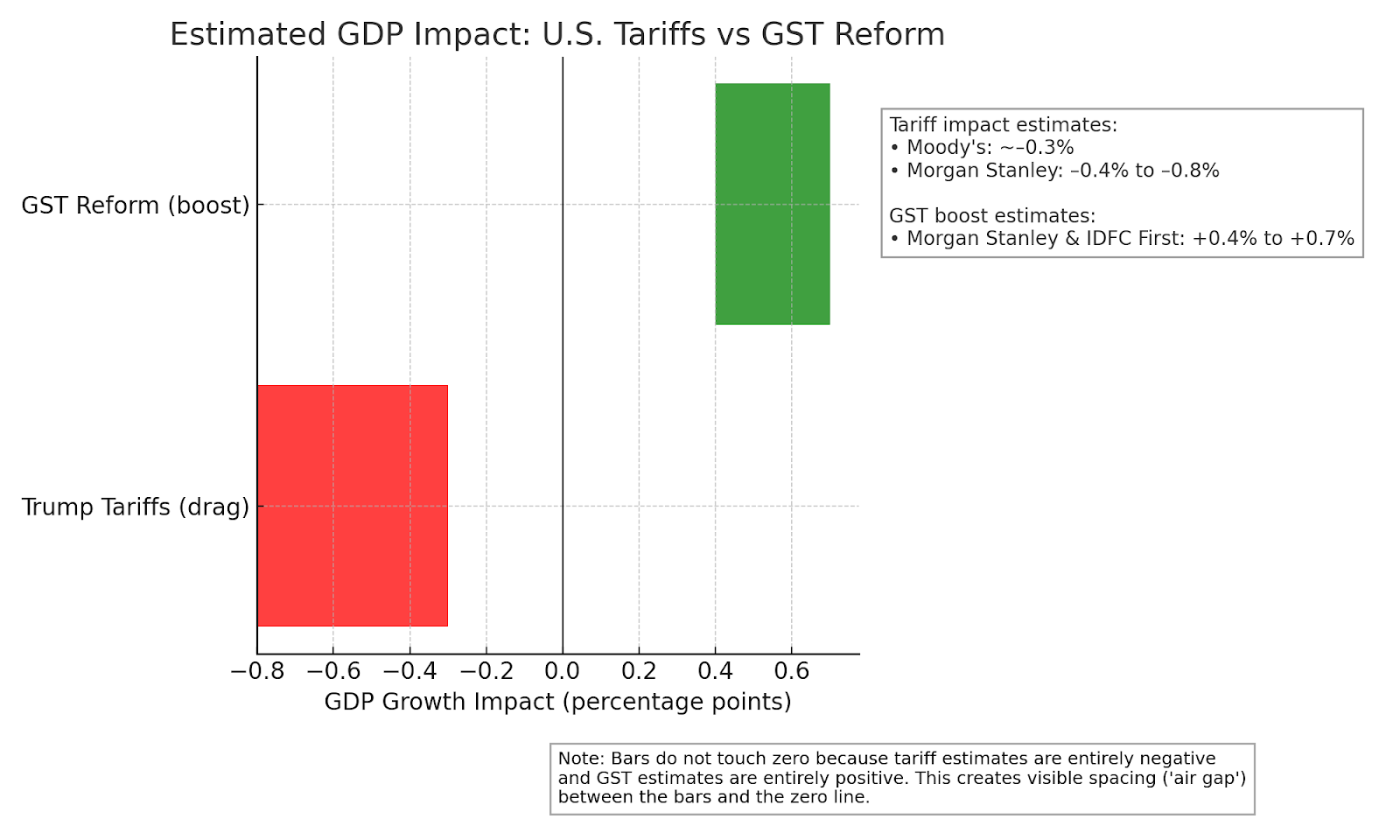

Earlier this month, Washington announced 50% tariffs on a wide range of Indian goods, effectively doubling existing duties. Nearly $60.8 billion worth of exports to the U.S. are covered. Economists estimate the actual drag on GDP growth will be between 0.3 and 0.8 percentage points, as some exports may still flow, others may be redirected.

Faced with these external headwinds, the Indian government has opted to fight back with a boost to domestic consumption. Prime Minister Modi announced sweeping GST reforms that collapse four tax slabs into two: 5% and 18%, with a separate 40% rate for luxury and sin goods. Nearly 99% of items previously taxed at 12% will now fall to 5%, and 90% of goods taxed at 28% will move to 18%.

The changes mean that everything from small cars and two-wheelers to air conditioners, refrigerators, footwear, cement, and even insurance premiums will become cheaper. Analysts expect a strong demand response. Kotak Securities projects additional consumption of about ₹2.4 lakh crore ($30 billion), or almost 1% of GDP. Auto sales, in particular, could jump 15–20% if GST rates fall by 10 points. Consumer durables and building materials should benefit, especially as the changes take effect before the festive Diwali season.

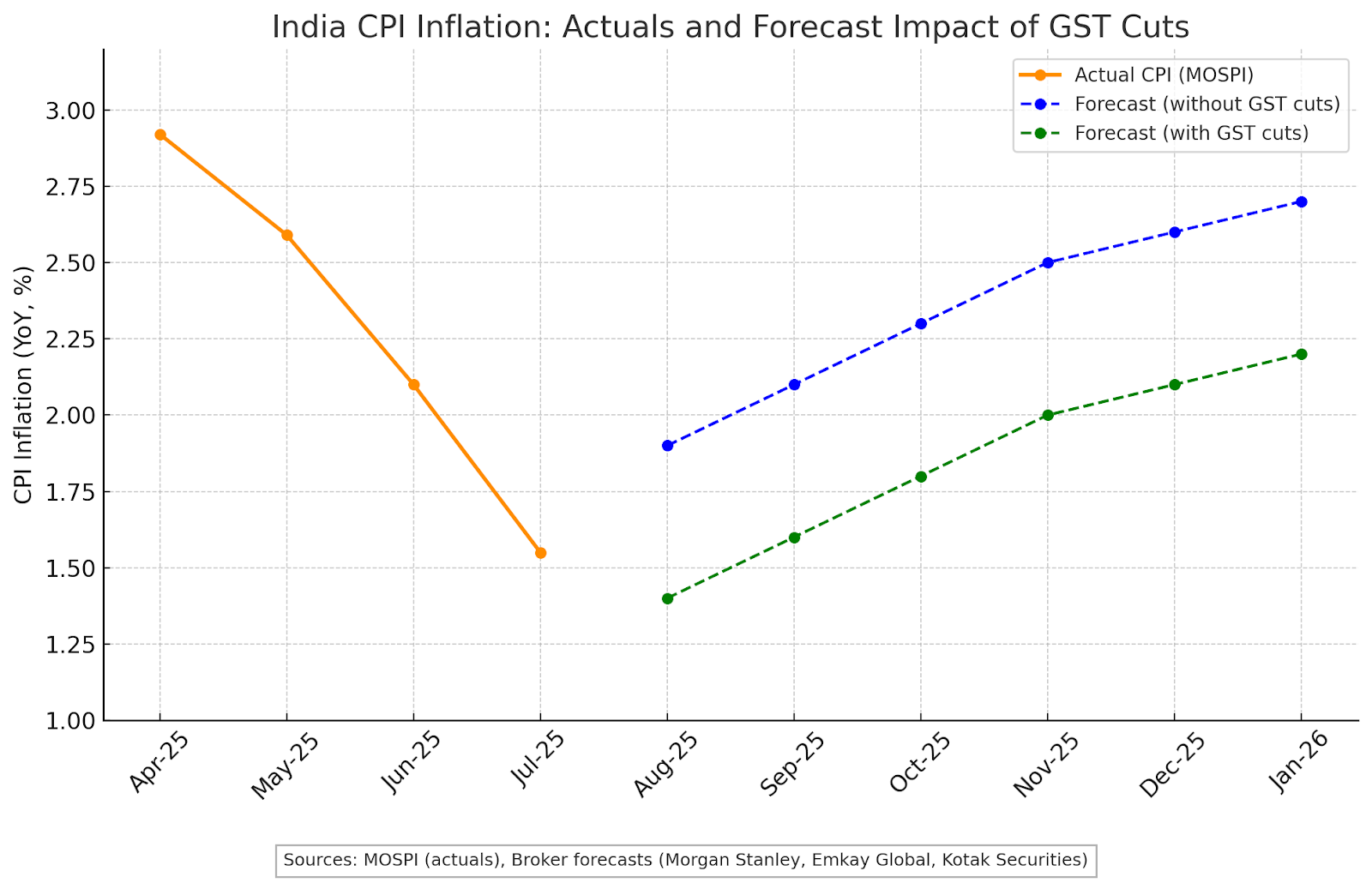

There is also an inflation benefit. Because indirect taxes feed directly into consumer prices, lower GST rates will push inflation down. India’s CPI inflation was already at a multi-year low of 1.55% year-on-year in July 2025. Broker estimates suggest the GST overhaul could shave an additional 40–60 basis points off the counterfactual path, giving households greater purchasing power and allowing the Reserve Bank of India to stay accommodative.

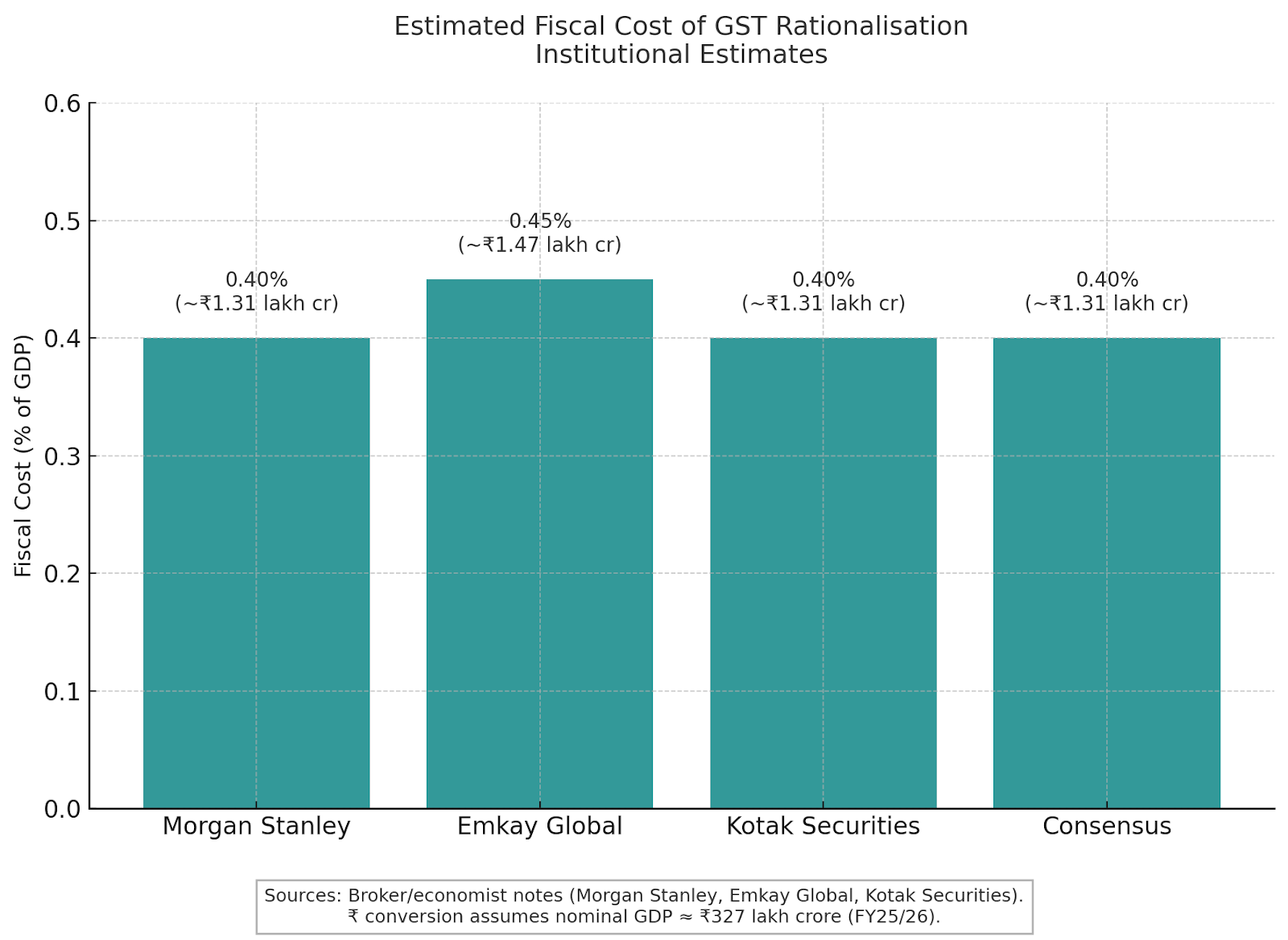

The fiscal cost of the GST reform is estimated at about 0.4% of GDP in lost revenues, but economists argue that stronger consumption will offset much of this through higher collections elsewhere. With multipliers above 1.0, each rupee of tax cut could generate more than a rupee in additional activity.

The crucial question is whether the GST stimulus can neutralise the tariff shock. On paper, the ranges overlap closely: tariffs are estimated to knock 0.3–0.8% off GDP, while GST reforms are expected to add 0.4–0.7%. In the mid-case scenario—say a 0.6% tariff drag and a 0.6% GST boost—the effects nearly cancel out, leaving India on track for 6.3–6.5% growth. If tariffs persist at their harshest and consumer demand proves weaker than expected, growth could dip modestly below 6%. If trade talks soften the U.S. stance, the GST boost could turn net positive.

Moody’s expects government support to keep growth close to 6.3%, while Morgan Stanley maintains a 6.5–6.8% forecast, citing India’s resilient domestic demand. The Reserve Bank of India, though cautious on external risks, has also indicated confidence in sustaining momentum. Importantly, India’s biggest export earners—pharmaceuticals, IT services, and energy—are not directly affected by the tariffs.

Looking forward, India’s ability to diversify export markets and sustain domestic consumption will be key. Exporters are already seeking buyers in Europe, the Middle East, and Southeast Asia. At home, lower GST rates, combined with earlier income-tax relief and RBI’s supportive stance, should underpin household spending.

For investors, the outlook is nuanced. Export-oriented stocks, especially textiles and jewellery, face earnings pressure, but consumer-facing sectors—autos, durables, cement, and insurance—look set to benefit. Markets have already reacted positively, with rallies in domestic demand plays following the GST announcement.

The message is clear: while external shocks can disrupt, India’s policy agility and structural consumption base provide a powerful cushion. By lowering prices and boosting demand, the GST overhaul gives India a realistic chance to offset U.S. tariff pains and keep its growth story intact at around 6.3–6.5% this year.