The Union Budget 2026 adopts a cautious and conservative stance at a time when demand conditions remain weak and inflation is unusually low. While the Budget avoids policy disruption and maintains fiscal discipline, it does little to stimulate consumption or provide a near-term growth impulse, despite clear macroeconomic space to do so.

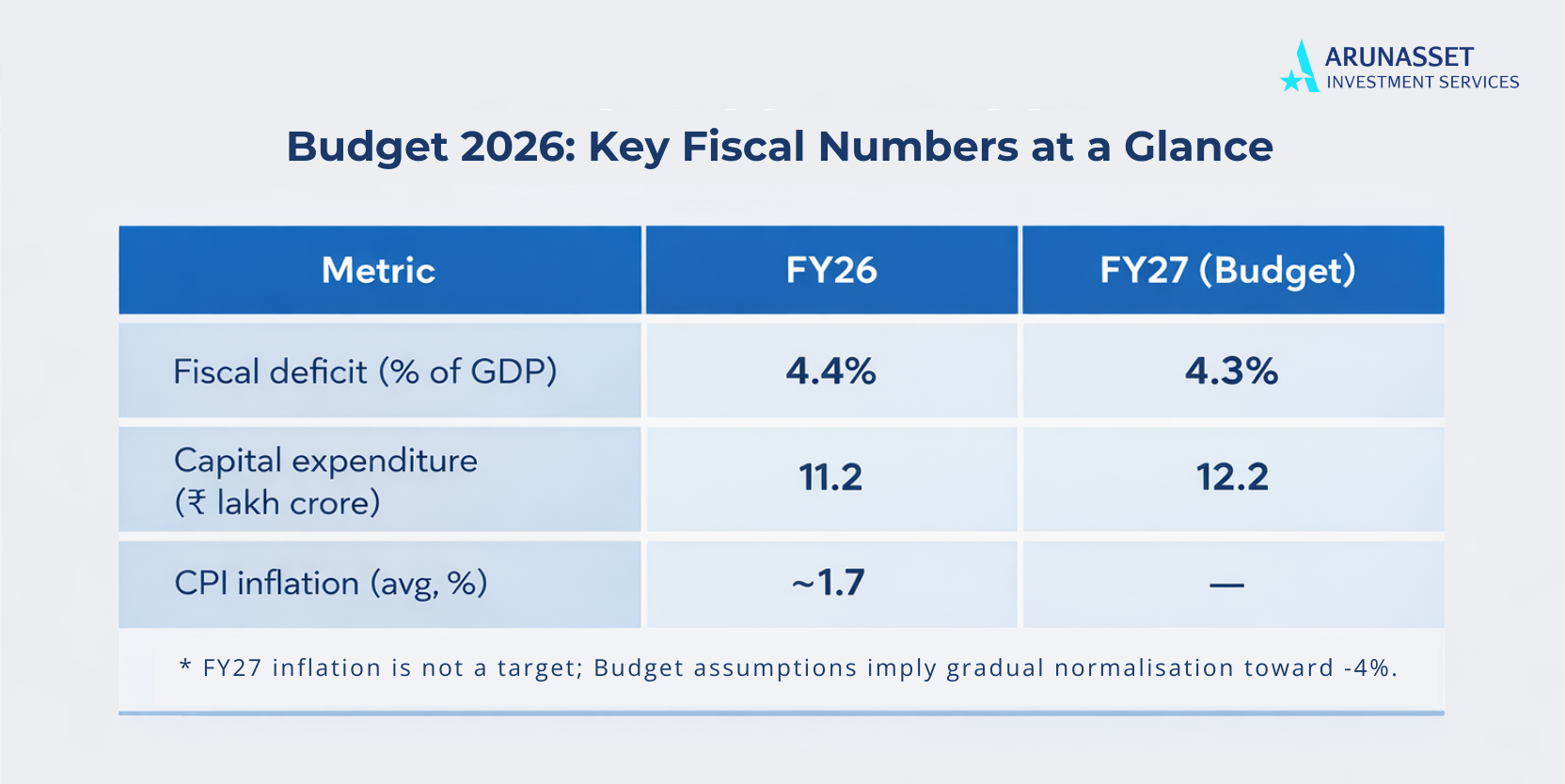

CPI inflation averaged around 1.7% during FY26 so far (April–December), supported by easing food and fuel prices. December inflation stood at just 1.33%, with the preceding months even lower. In this low-inflation environment, the government had room to support demand through income tax relief, higher transfers, or targeted spending. The Budget, however, introduces no such measures. There are no changes to income tax laws, and no initiatives aimed at directly boosting household consumption. As a result, fiscal policy remains largely neutral on demand, shifting the burden of growth revival to monetary policy and the private sector.

From a market perspective, the absence of changes to capital gains tax laws is a clear positive. After several years of frequent adjustments and uncertainty around capital gains taxation, the decision to leave the framework untouched removes a key source of policy risk. This reduces the likelihood of market disruption and provides greater predictability for investors.

On the fiscal side, consolidation continues gradually. The fiscal deficit target for FY27 has been set at 4.3% of GDP, compared with 4.4% in the previous year. While the improvement is marginal, it signals continuity in the government’s medium-term fiscal consolidation path rather than any sharp tightening. Gross tax collections for FY26 are estimated at ₹42.7 lakh crore, reflecting growth of around 11% over FY25. Direct tax collections are projected at ₹25.2 lakh crore, while indirect taxes are estimated at ₹17.5 lakh crore.

GST revenues for FY26 are projected at ₹11.78 lakh crore, also implying year-on-year growth of about 11%. FY27 GST estimates will be important to monitor, particularly as rate rationalisation measures implemented since September 2025 are expected to influence consumption and compliance trends.

Capital expenditure has been increased in absolute terms, with the FY27 capex target raised to ₹12.2 lakh crore from ₹11.2 lakh crore in the current fiscal year. However, capital expenditure as a percentage of GDP remains broadly unchanged from last year. This indicates that the government is maintaining its existing infrastructure push rather than delivering an incremental boost to economic activity. While supportive for medium-term growth, this approach does little to address near-term demand softness.

The macro assumptions underlying the Budget remain conservative. Nominal GDP growth for FY26 was initially projected at 10.1% but was later revised down to around 8%, largely due to lower-than-expected inflation rather than weak real growth. For FY27, the Budget is expected to assume nominal GDP growth of 10.5–11%, implying a normalisation of inflation toward the RBI’s 4% target.

Overall, Budget 2026 prioritises stability, predictability, and fiscal discipline. While this reduces policy risk and avoids market shocks, it also means that fiscal policy is not being actively used to revive demand. Growth over the coming year will therefore depend more on monetary easing and private sector recovery than on direct fiscal stimulus.