Arun Patel, Founder and Partner at Arunasset Investment Services, recently authored an article in The Economic Times exploring the shift in India’s investment patterns over the past 15 years.

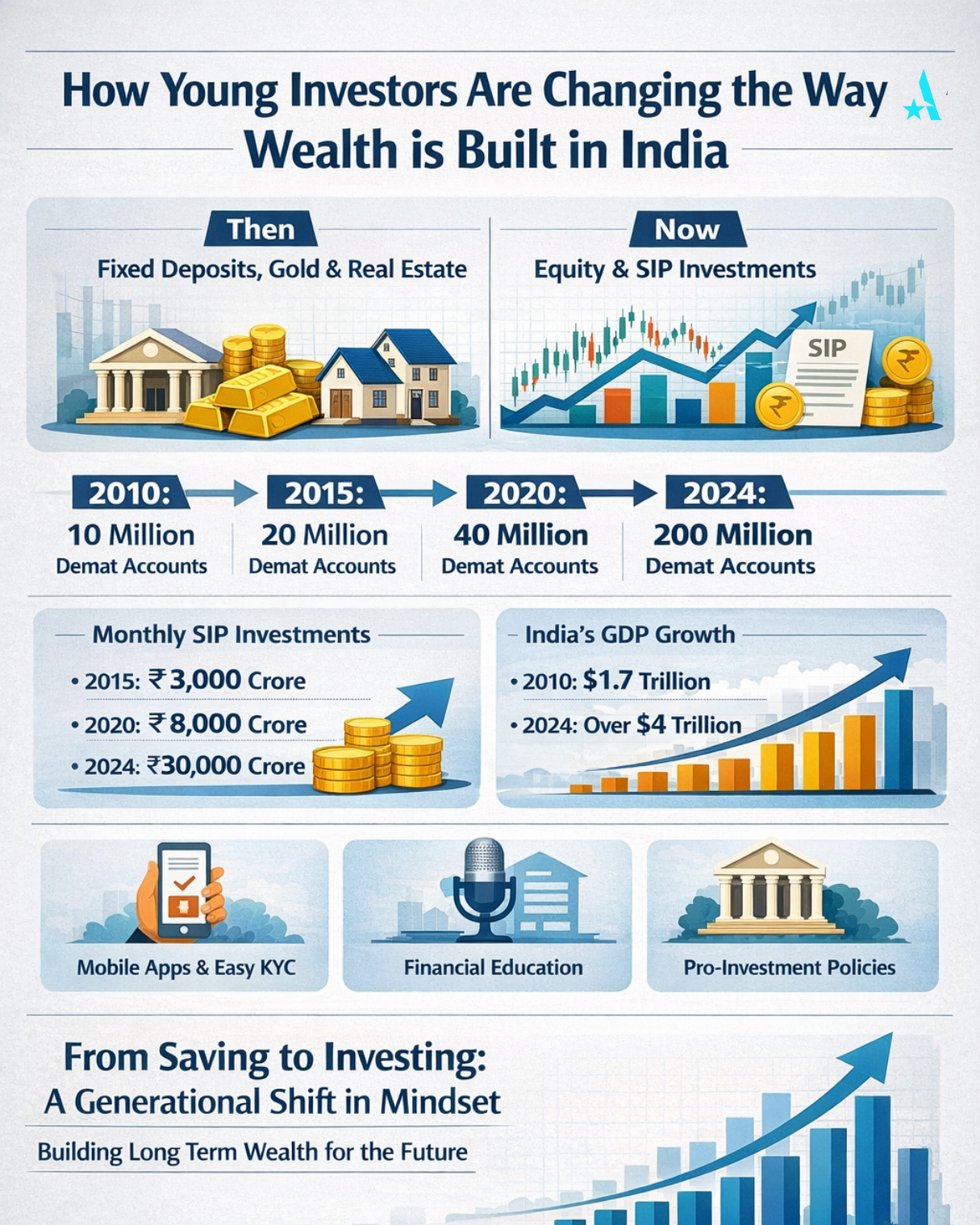

He outlines how young investors are steadily moving away from traditional instruments like fixed deposits, gold, and real estate — and toward equity and market-linked options. Backed by growing access to mobile investing, government policies, and a maturing financial culture, SIPs and demat accounts are now a common part of how young India builds long-term wealth.

Key insights include:

- In 2010, equity made up just 2.5% of India’s household financial savings. By 2020, it reached 6%, and by 2024–25, it’s expected to touch 9–10%.

- Demat accounts rose from 10 million (2010) to 200 million (2025) — most held by young, first-time investors.

- Monthly SIP investments have grown from about ₹3,000 crore (2015) to ₹30,000 crore today, backed by over 80 million SIP accounts.

- This shift is enabled by easier access to investing: mobile apps, instant KYC, UPI, and improved digital infrastructure.

- Government policy has also supported this trend — for example, allowing the EPFO to invest up to 15% in equities and NPS investors to allocate up to 75%.

- Between 2010 and now, India’s GDP has more than doubled — from $1.7 trillion to over $4 trillion, averaging 6% real growth despite global challenges.

📖 Read the full article in English: Young investors have transformed the way money is made in India, shifting from FDs and gold to equities.

📖 Original Article Link in Hindi: Young investors have transformed the way money is made in India, shifting from FDs and gold to equities.