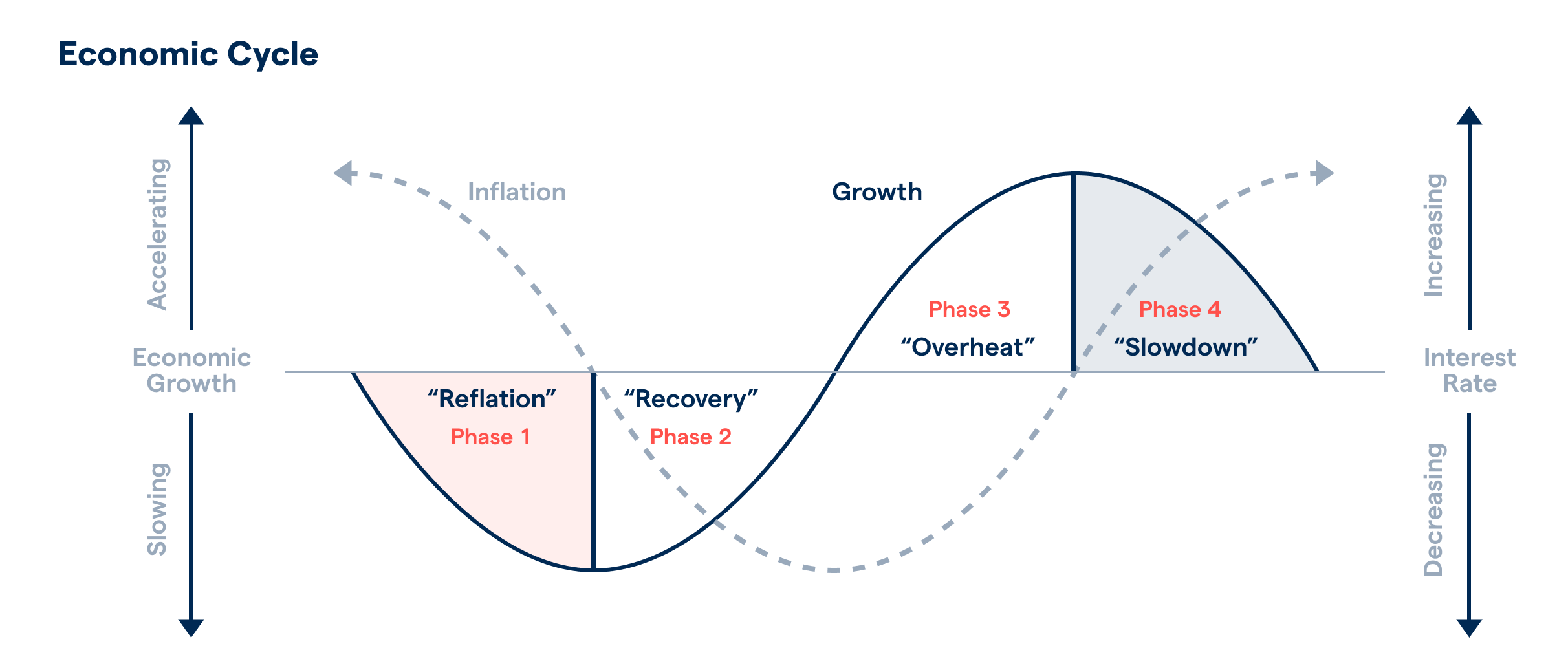

Arunasset’s 12-month view on Indian markets can be summed up in one word — Reflation. After two years of disinflation, tight liquidity and elevated real rates, the policy gears are finally shifting toward growth. The Reserve Bank of India’s 50-basis-point rate cut in June, its dovish tone on inflation, and expanding credit all signal a turn to a more supportive monetary environment. The government, meanwhile, continues to prioritise infrastructure spending, using healthy tax revenues to sustain capital outlays. Together, these moves mark the first coordinated reflationary turn since the 2014–17 recovery.

Reflation, simply put, means policies that revive growth and moderate inflation after a sluggish phase. In India’s case, it isn’t reckless stimulus; it’s a calibrated effort to lift consumption and capex while keeping inflation near target. With CPI below 3 %, the RBI has space to ease further without risking macro stability. Real rates remain among Asia’s highest, giving room to nurture growth even as price pressures stay contained. For markets, this is the most consequential shift of 2025 — a backdrop where liquidity improves, borrowing costs fall, and profits broaden.

Lower interest rates ripple quickly through corporate balance sheets. Financing costs are already at decade-lows, and as demand recovers, operating leverage strengthens. A modest rise in revenues can now deliver a sharper rise in profits — visible in autos, construction and banks. Auto makers are posting double-digit volume gains, engineering firms have record order books, and lenders are seeing robust credit growth with cleaner asset quality.

If these trends persist, India could see its broadest profit expansion in a decade. BSE-500 earnings, up around 15 % in FY25, look set to maintain healthy double-digit growth over the next two years. The setup resembles past reflation cycles — the post-2014 recovery and the 2020-22 rebound — but with stronger balance sheets and far less external vulnerability.

Reflation typically favours cyclical sectors first. Banks and financials lead as credit accelerates and provisioning costs fall. Capital-goods and infrastructure companies benefit from higher public investment, while lower rates lift project viability. Consumption follows — from entry-level vehicles to housing and discretionary retail. Real estate, after years of consolidation, could enjoy its broadest recovery since 2010, supported by affordable EMIs and steady wages.

Mid- and small-caps thrive in such environments, though valuations demand caution. Liquidity-driven rallies can outpace fundamentals, but the underlying story remains one of earnings catch-up. Arunasset believes selectivity will matter most — favouring companies with strong balance sheets, pricing power and exposure to credit or investment cycles. Large-cap banks, engineering majors, cement and consumption names with margin tailwinds remain preferred.

The macro numbers reinforce the thesis. Nominal GDP near 9.5 %, credit growth around 16 %, and inflation anchored near 3 % create a rare “Goldilocks” mix. The current-account gap is modest, reserves exceed USD 700 billion, and fiscal consolidation stays credible. These buffers allow India to reflate without destabilising the rupee or bond markets. In a world still struggling with sticky inflation and slow growth, India’s balance of stability and momentum looks distinct — and investible.

Risks persist: oil shocks, food-price spikes, or a global tightening in liquidity could temper the RBI’s easing bias. But even under conservative assumptions, the domestic profit cycle has turned decisively upward. Unlike previous cycles, this one is balance-sheet-driven — powered by real credit expansion and stronger corporate discipline.

Arunasset’s base case for the next year is clear: India’s markets are entering a reflationary sweet spot. Broad earnings momentum, stable inflation and a patient central bank provide the foundation for a durable bull phase rather than a fleeting rally. If policy support holds and global conditions stay calm, the coming year could echo India’s best post-reform upswings — a period when liquidity, profitability and confidence rise together. Reflation is not just a forecast; it’s the defining theme of India’s market story for the year ahead.