As global economies grapple with rising debt and policy uncertainty, India’s steady hand on fiscal discipline stands out. In a world where the U.S. continues to borrow from tomorrow to fund today, discerning investors are shifting focus to markets with clarity and conviction. This article explores why India isn’t just surviving the global financial storm—it’s quietly positioning itself to thrive.

In today’s global financial landscape, discerning investors recognize that the battle lines are being drawn not only in boardrooms but across entire economies. For Indian stock market investors, the contrast between the United States’ structural overspending and India’s steady, disciplined economic approach is more than an academic debate—it is a powerful signal for where to place confidence and capital.

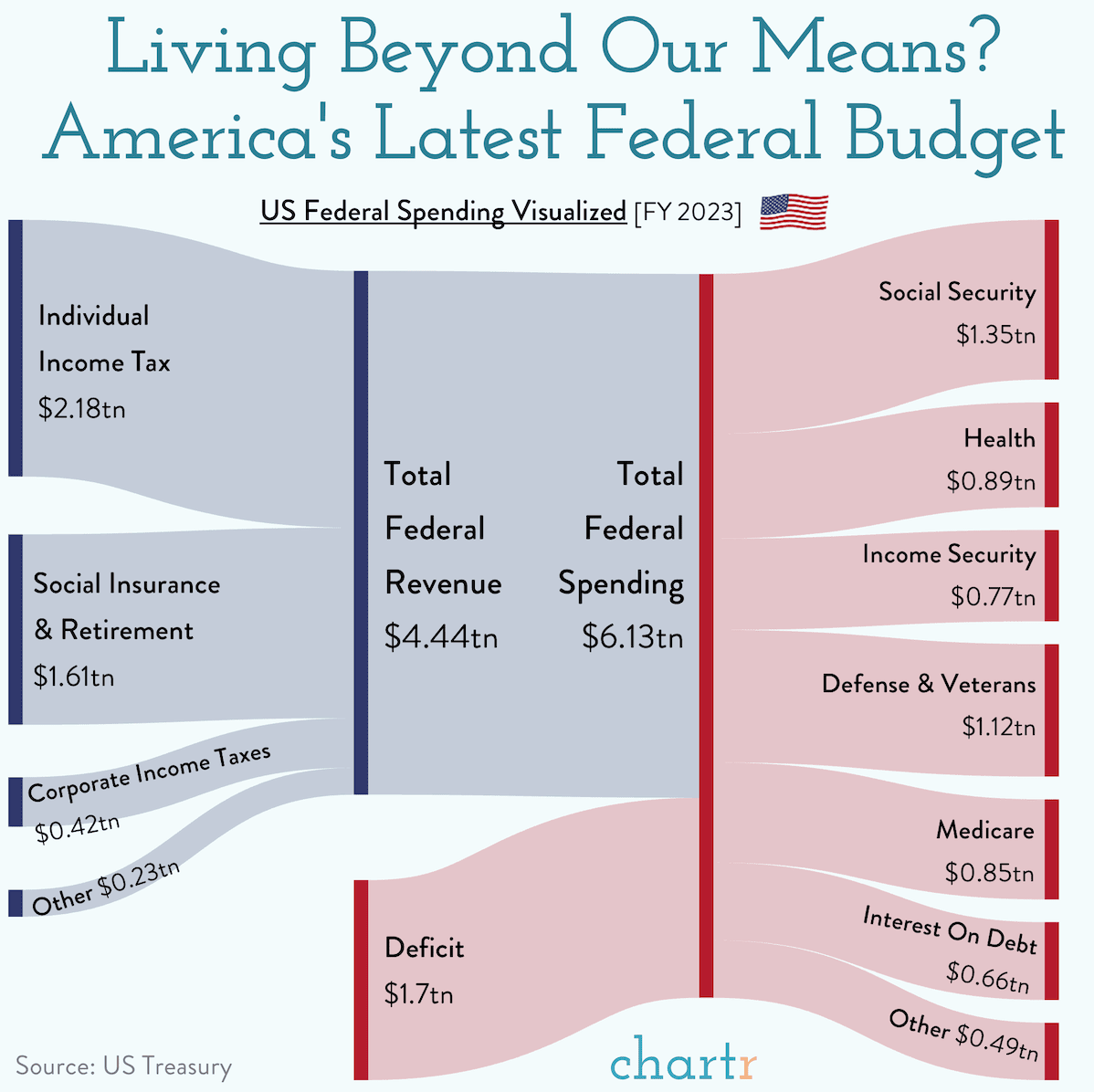

Over recent decades, America has become accustomed to living on borrowed money—a cycle in which public and private spending exceeds its income, effectively mortgaging its future. Despite efforts by various administrations to curb this unsustainable trend, fiscal reform remains a daunting challenge. The U.S. economy continues to be driven by short-term measures and political maneuvering, a pattern that leaves it perpetually vulnerable to shifts in investor sentiment and global shocks.

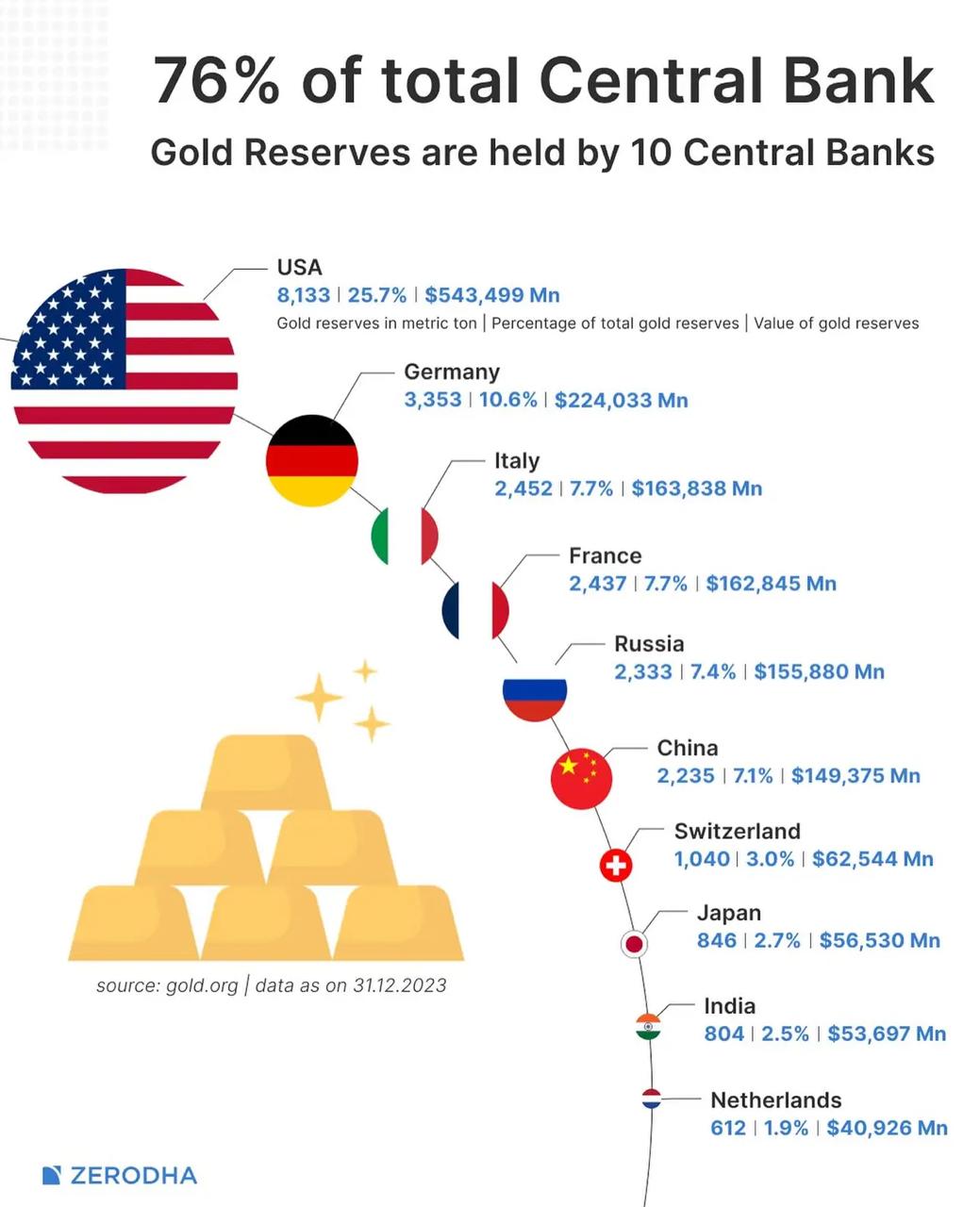

Even as the U.S. grapples with these fiscal imbalances, the dollar persists as the world’s reserve currency—a relic of historical events where geopolitical crises and post-war recovery processes left America as the dependable alternative. The dollar’s global dominance has, in part, allowed U.S. policymakers to finance consumption largely through debt. While this might seem like a safe haven on the surface, the underlying fragility of an economy running on perpetual deficits is a cause for concern among global investors.

America’s consumption-driven model relies heavily on importing goods and services from manufacturing powerhouses like China and emerging economies such as India. But here’s the paradox: America buys the world, and the world funds America. The dollars that flood out through trade deficits are often reinvested right back into U.S. financial assets—especially government bonds. This keeps American interest rates low and markets artificially buoyant. Meanwhile, the countries supplying these goods—like China and India—end up holding trillions in U.S. paper, hoping for meager returns. Their markets remain underpriced, under-owned, and underappreciated. In essence, America consumes the cake while the rest of the world settles for the crumbs.

In the midst of these structural challenges, President Trump’s tariff plans added another layer to the U.S. economic narrative. Designed to protect domestic industries from what was perceived as unfair foreign competition, these tariffs were a double-edged sword. On one hand, they aimed to create a more level playing field for American manufacturers by penalizing imports from major trading partners such as China and the European Union. On the other hand, the tariffs sparked trade tensions and retaliatory measures from affected countries, adding uncertainty and volatility to global markets. For Indian investors, these developments underscored the risks inherent in a protectionist economic policy that could disrupt established trade relationships and ultimately hinder growth.

The question of whether Trump—or any future administration—can truly resolve America’s deep-rooted spending problem remains highly contested. While Trump’s efforts to implement fiscal discipline through measures like tariffs have been bold, they represent only short-term fixes in the face of a structural issue ingrained over decades. The challenge lies in overhauling a system that has relied on continuous borrowing to fuel consumption. Many analysts are skeptical that such political maneuvering can swiftly or sufficiently alter the nation’s entrenched spending habits, suggesting that any significant improvement would require a long-term commitment to reform—a commitment that has historically proven elusive in the U.S. political environment.

A significant portion of global savings—estimated to be 60–70%—is entrenched in U.S. bonds, a testament to the dollar’s enduring appeal. However, this reality also exposes the system’s vulnerability, hinging on continued external capital inflows rather than organic economic strength. As investors watch these dynamics unfold, the risks inherent in the U.S. financial model become increasingly apparent, especially when contrasted with markets emerging from disciplined fiscal environments.

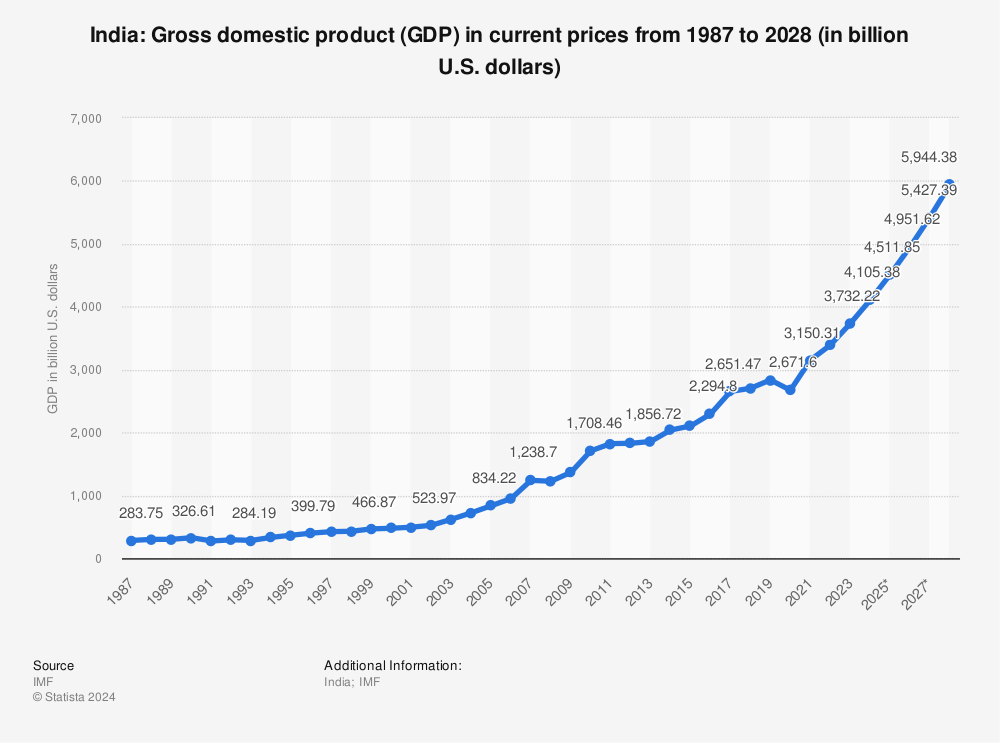

India presents a compelling alternative amid these global shifts. The country’s trajectory over the past decade has been marked by a focused commitment to macroeconomic stability. The fiscal deficit has been on a steady decline, and inflationary pressures are being managed with a prudence that stands in stark contrast to the volatility experienced in more indebted economies. For the Indian stock market investor, these factors translate to a more predictable and sustainable growth environment—one where long-term investments can benefit from reliable returns and compounding gains.

Drawing a parallel to a well-managed multinational company like Nestlé, India’s economy embodies a consistency that is increasingly rare in today’s financial markets. This reputation for stable growth is not merely a consequence of prudent policymaking; it also reflects a broader strategic vision that favors long-term planning over the short-term fixes that often characterize American political cycles. While the U.S. continues to oscillate between bold fiscal experiments and reactive measures, India’s steady course provides a haven for investors seeking both stability and growth potential.

Furthermore, the long-term strategic orientation seen in India—and even in China with its extended planning horizons—offers an attractive counterpoint to the rapid turnover of U.S. political and economic strategies. The absence of stringent short-term political cycles allows India, to implement policies that encourage enduring investor confidence. For Indian stock market investors, this macro stability is more than a comforting narrative; it is the foundation upon which future market opportunities are built. This is where the India story becomes especially compelling: India is a secular bull waiting to explode.

Whether Trump slashes U.S. spending or continues on the path of debt-fueled growth, the outcome is the same—India stands to gain. If the U.S. economy tightens and bond markets unwind, global capital will seek stability and growth—and India, with its solid macro fundamentals, becomes the natural destination. If the U.S. keeps printing and spending, the relative strength of India’s fiscal discipline shines brighter. Either way, India eats.

In summary, the juxtaposition between America’s borrowed future and India’s disciplined economic reform has never been more instructive for investors. While U.S. fiscal policy continues to rely on debt and reactive measures, India’s commitment to lowering deficits and taming inflation provides a clear signal of a market on the rise. For those watching global markets closely, the message is clear: in an era of economic distortion and geopolitical noise, India offers something rare—clarity, consistency, and compounding potential.