Our focus is on businesses that have a proven track record and future potential to generate free cash flows and show consistent growth. We pick businesses that are exceptionally high in integrity and have quality management.

Our focus is on businesses that have a proven track record and future potential to generate free cash flows and show consistent growth. We pick businesses that are exceptionally high in integrity and have quality management.

Our portfolio is a subset of BSE 200 companies and includes 20 high performing businesses. These businesses are selected by our tested quant-based investment strategy, and are held in equal weightage in the portfolio.

Our strategy ensures a data driven portfolio with exclusion of analyst bias. The components of our strategy are integrity, quality of business, greatness of business, valuation and momentum.

The team from Arunasset and Tamohara has a combined experience of over 20 years in capital markets.

We share regular statements, periodic tax reports and provide any operational support required.

Each client is issued a demat account where the stocks are held. This trading platform is provided by one of India’s stock broking companies, Prabhudas Lilladher.

This plan is for investors who would like to make an investment of a minimum of 10 lacs.

Portfolio Parameters

| Parameters | Arunasset – Tamohara All Seasons Investment Strategy |

| Investment Objective | Growth through investment in companies that show potential for positive cash flows. Integrity of company. Quality of management. |

| Number of Businesses | 20 |

| Investment Horizon | 5 years |

| Sector Preference | Agnostic |

| Market Cap Preference | Large and Mid Cap |

| Benchmark | BSE 200 |

| Portfolio Deployment | Immediate |

| Portfolio Rebalancing | Every 6 months |

| Expense Ratio | 2% PA (1% paid semi-annually) |

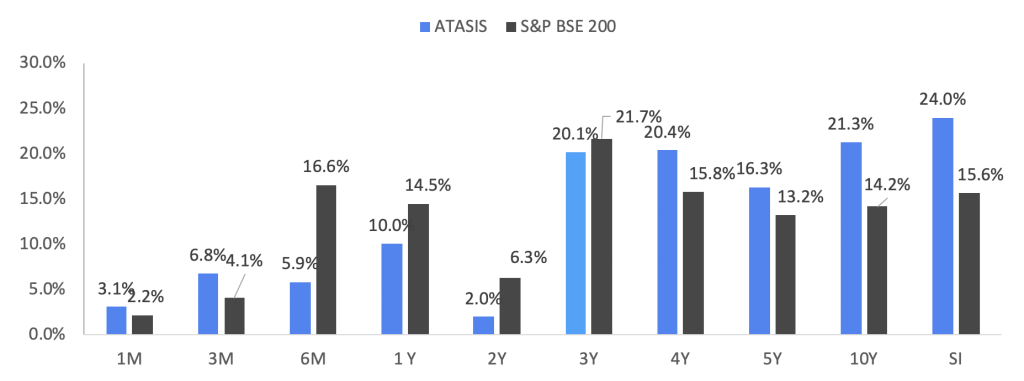

Strategy Performance

Arunasset – Tamohara All Seasons Investment Strategy has outperformed BSE 200 consistently.

Arunasset – Tamohara All Seasons Investment Strategy vs BSE 200 (Since 2002)

*As of 30th September 2023. Strategy performance based on back testing result. Returns over one year are annualized. ATASIS is short for Arunasset – Tamohara All Seasons Investment Strategy.

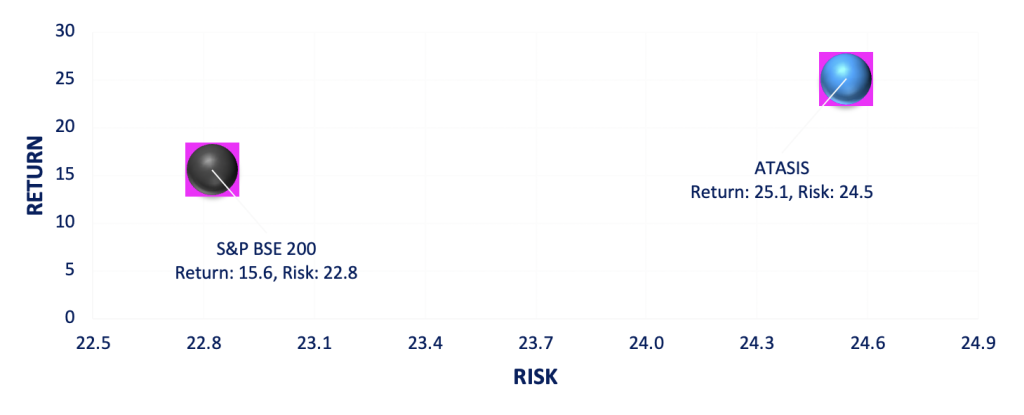

Arunasset – Tamohara All Seasons Investment Strategy – Risk Return

*As of 30th September 2023. Strategy performance based on back testing result. Data since 2009 as SBI Small Cap Data available since Feb 15th 2009.

Strategy Overview

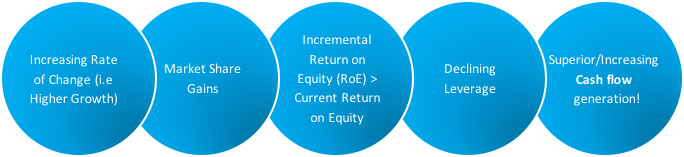

We believe businesses run on cash flows alone. Positive cash flows enable a business to settle debts, reinvest in business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges.

We analyze BSE 200 companies along the five quantifiable pillars of Arunasset Tamohara All Seasons Investment Strategy. We consider company data over a 5 year time period for this.

*The rate of change in the economy is accounted for in the calculation. We use 5 years rolling data for each factor of Arunasset Tamohara All Seasons Investment Strategy, except valuation and momentum.

Strategy Composition

| Number | Component | Weightage |

| 1 | Integrity | 45% |

| 2 | Quality of Business | 25% |

| 3 | Greatness of Business | 20% |

| 4 | Valuation | 5% |

| 5 | Momentum | 5% |

Who are we

Arunasset

Arunasset Wealth Management Services was founded in 2006 with the aim of helping clients achieve their financial goals and grow their wealth. They currently help over 70 families manage their wealth; and have over 300 crores in assets invested under their advice in capital markets. Their biggest testimony is their happy client base, 80% of which has come through client referrals.

Arunasset lead the strategy for Arunasset Tamohara All Seasons Investment Strategy and ensure that the formula is relevant keeping in mind the dynamic capital market. Their promoters manage all client relationships themselves, ensuring personalized and timely service. They believe in being transparent, and share regular portfolio reports and market updates, and will provide any required operational assistance.

Tamohara

Founded in 2015, Tamohara Investment Managers is a SEBI Registered Portfolio Manager and Registered Investment Advisor. Tamohara is founded on the principles of long-term compounding and normalization, with a focus on absolute returns. They look at business fundamentals rather than current stock prices, and value research over hearsay. Tamohara will be doing the research and running the strategy formula for Arunasset Tamohara All Seasons Investment Strategy.

Prabhudas Lilladher

Founded in 1944, Prabhudas Lilladher is India’s leading stock broking company. Arunasset Tamohara All Seasons Investment Strategy will be using their platform to issue demat accounts to clients.